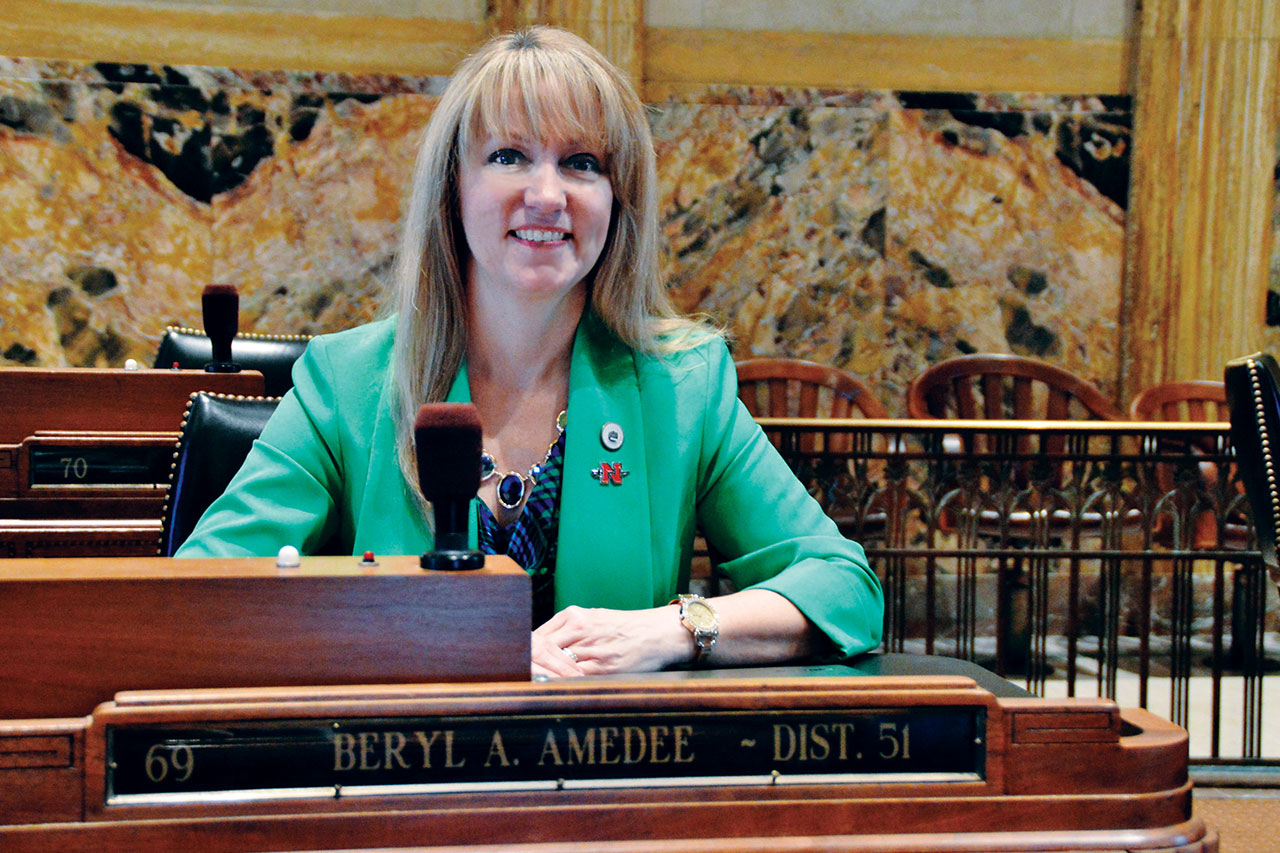

A Q&A With Rep. Beryl Amedee

July 17, 2019

Lin Kiger | President & CEO, Lafourche Chamber of Commerce

July 17, 2019U.S. CONFLICT WITH IRAN THE STORYLINE TO FOLLOW THIS FALL

Regular followers of this monthly update know that the price of oil has been a bit of a roller coaster in 2019 — up sometimes, down sometimes and always in a somewhat unpredictable state of flux.

Last update, the price was down — more than $10/barrel from May to June.

This month? Things are somewhat looking up again and prices have rebounded and offset some of their early-summer losses.

Why?

In a word, Iran.

The price of oil crept back up in mid-June toward July, inching toward $60/barrel at press-time in mid-July.

Increasing tensions between the United States and Iran are the reason for the spike, as there are growing concerns that President Donald Trump will stiffen sanctions against the oil-rich nation. Some even fear that the tensions could escalate to military conflict if calmer heads don’t prevail.

“The tensions between the United States and Iran are going to be one of the factors that will heavily dictate the price of oil throughout the summer and likely for the remainder of 2019,” said Jim Ritterbusch, of Ritterbusch and Associates in early July. “What happens between those nations will be why the price rises, falls or stay steady in the next several months.”

The relationship between the United States and Iran hasn’t exactly been cozy in recent years, but tensions really escalated last month when Iran shot down a U.S. military drone. The Iranian government said after the incident that the aircraft was “spying” in Iranian airspace.

The United States has since released information disproving that, showing that it was in international airspace over the Strait of Hormuz at the time of its demise.

President Donald Trump reacted swiftly to the Iranian action. He’s threatened the Middle Eastern country several times publicly and on social media. In the days the drone was shot down, he tweeted that another attack would be met with “overwhelming action” and in some instances “obliteration.”

So what does this have to do with the price of oil?

Well, Iran is one of the largest oil-producing countries in the world.

They were already facing severe economic sanctions from the United States, which heavily limited the amount of their oil on the global market — thus affecting global supply.

On top of that, if they’re in severe conflict with the United States or any other major nation, they’re not certain to produce consistently at all, which could scare buyers into a hike in price.

“Iranian supply concerns were already existent amidst sanctions,” Ritterbusch said. “Now, those concerns are even more heightened.”

The price of oil last month climbed back over $60/barrel right in the immediate aftermath of the drone incident.

But it’s since sunken a little bit — hovering in the high $50s/barrel at press-time.

So what stopped a continued climb?

Global demand.

Even with the concerns about Iran, a ceiling quickly emerged on the price hike because of continued concerns about global demand and the worldwide economy.

Analysts say they’re not certain about the end result of the United States’ trade war with China, citing concerns that the battle could negatively impact both nations and hurt the global economy.

In May, Japan’s machinery orders fell for the first time in 2019 — a sign that experts say could be showing that the global trade war is hurting global business.

The price is also being heavily influenced by the influx of U.S. shale production, which is keeping large quantities of American oil on the market.

But that influx, experts warn, is not long-lasting, and could lessen in 2020.

Port Fourchon CEO Chett Chiasson said recently that there are many statistics that show that the shale plays are going to someday dry up, which could far more oil and gas business back into the deep waters of the Gulf of Mexico, which would be a boost to our local economy.

But, as we’ve seen throughout 2019, when making predictions about oil, write them in pencil, because what’s forecast today may be drastically different tomorrow depending on how things are going in global politics. •