40 under 40: Meet Lafourche’s top 40 up-and-comers

November 26, 2014

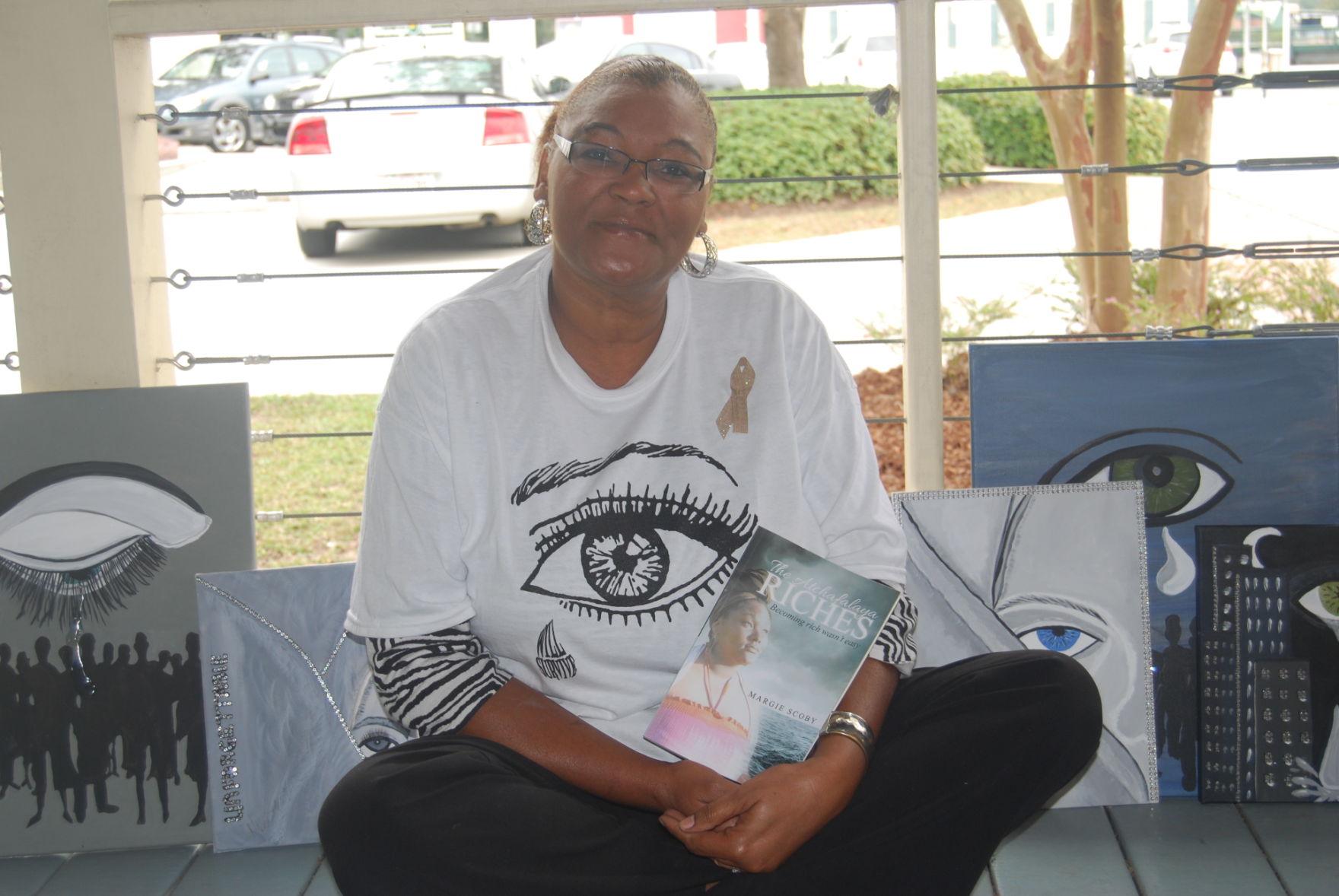

‘Atchafalaya Riches’

November 26, 2014Dear Dave,

What’s the difference between a Chapter 7 bankruptcy and Chapter 13 bankruptcy?

– Claudia

Dear Claudia,

Chapter 7 bankruptcy is what most people think about when they hear the word “bankruptcy.” It’s total bankruptcy, almost like dropping an atomic bomb on your entire financial picture.

Virtually all of your unsecured debt (except student loans, child support and money owed to the IRS) is wiped out.

These things are not bankruptable. About 98 percent of the time, creditors of your other unsecured debt – things like credit cards and alike – get nothing. Items that are secured debt, such as your car or house, are treated a little bit differently. If you’re behind on payments, you may be allowed to get current.

In most cases, banks will allow you to re-sign in a process called reaffirming the debt.

Chapter 13 bankruptcy is a payment plan structured over five years. In it, you have to pay all of your secured debt. If it has a lien on it, you pay 100 percent to keep the item. You also have to pay a portion of your unsecured debt.

Again – like in Chapter 7 – debt to the IRS, child support and student loans don’t go away. For any other unsecured debt, you can pay a percentage of what’s owed. An overall payment plan is developed, and you make those payments for five years.

I’m not a big fan of either one.

– Dave

———-

100 percent mortality rate

Dear Dave,

Do you think it’s unreasonable to ask my 76-year-old husband to have a will drawn up? He had one made when we lived in Florida, but we moved to Georgia. He won’t do it, because he says wills aren’t recognized in Georgia?

– Cam

Dear Cam,

Wills aren’t recognized in Georgia? Where did he get his legal advice, in a bar or pool hall?

OK, let’s straighten this out. The will he had drawn up in Florida wouldn’t be recognized in Georgia, but he could have one made in Georgia that would be absolutely valid and legal. Everyone: No matter where you live, you need a will. If you die without a will in place, your family has to go through the court and jump through all sorts of hoops to settle the estate. The process can take several months. No one should leave their loved ones in that kind of predicament, when having a will drawn up is such a simple an inexpensive process.

Everyone needs a will, Cam. Human beings have a 100 percent mortality rate, OK?

No one is getting out of this thing alive. You need a will, a full estate plan with specific instructions on what to do with all your stuff after you die!

– Dave

————

Asking for a raise

Dear Dave,

What’s your advice on asking for a raise at work when you have more responsibility than a co-worker but the same title on paper? After being with my company four years, I feel like I should make more money and I have the right to complain about this.

– Vanessa

Dear Brian,

The reason you won’t have to pay into the premiums anymore is because you built up enough savings, and they are not paying you enough on the savings to amount to anything. The amount they should have been paying you versus the way they were ripping you off will buy the life insurance.

It’s not like you can pay for it because you still have probability of death. As long as there’s a probability of death there’s a cost to life insurance. The only question is whether you’re paying out of your savings account or your checking account. In this case, you’re paying out of savings.

The seven percent figure is just your surrender charge, so I’d get out of that policy soon. Here’s the problem, Brian. If you die today, do you know what they’ll pay? Face value. They won’t pay face value plus the savings you paid for. In other words, you’ll lose your savings.

I’d get term life insurance in place by the end of the week. Compare prices on term, because you’ll be surprised at the difference some companies charge for term insurance. Make sure you get good 15- to 20-year level terms policies valued at 10 to 12 times your annual incomes.

– Dave

EDITOR’S NOTE: Dave Ramsey is America’s trusted voice on money and business. He has authored five New York Times best-selling books: Financial Peace, More Than Enough, The Total Money Makeover, EntreLeadership and Smart Money Smart Kids. Follow Dave on Twitter at @DaveRamsey and on the web at daveramsey.com.