Sports gambling is on its way to Louisiana. Where’s the tax money going?

June 2, 2021

Human remains discovered in Golden Meadow woods; LPSO investigating

June 3, 2021By Ryan Nelsen, LSU Manship School News Service

Three bills that focus on tax relief for women moved through a Senate committee Wednesday.

The Senate Revenue and Fiscal Affairs Committee advanced the bills, which had already been approved by the House. The bills now head to the Senate floor.

HB 7, by Rep. Aimee Freeman, D-New Orleans, would end state sales tax on feminine hygiene products and diapers for adults and children. Freeman has labeled the bill as “ending the pink tax,” as the financial burden of buying these products disproportionately affects women.

Lift Louisiana, a women’s advocacy group, supported the bill, noting that Louisiana leads the nation in single-family households led by women. The group called the taxation of these products “an unnecessary and immoral financial burden.”

The bill is now in its fifth year in the legislature. It was originally carried by former Sen. J.P. Morrell, D-New Orleans. The bill has support from groups on both sides of the aisle, including the Feminist Majority of Louisiana and Louisiana Right to Life.

“I believe this is part of healthcare for women and children, especially for those who live on a very tight budget,” said Freeman.

A concern from Sen. Eddie Lambert, R-Gonzales, was that the bill would cost the state $10.5 million in tax revenue.

Freeman responded: “To me, $10.5 million, which is only .01% of the entire budget, is a worthwhile exemption for the women and children of Louisiana.”

The state sales tax is currently 4.45%, but local parishes and cities add their own sales taxes on top of that. The committee amended the bill to give municipalities the option of enacting the exemption.

The bill passed the House 62-32. If the bill is approved by the Senate and signed by the governor, the state sales tax on the products would end in July 2022.

Rep. Stephanie Hilferty, R- Metairie, also passed a bill, HB146, through the committee. Her bill aims to give a tax credit of $2,000 to mothers of stillborn babies.

The credit intends to alleviate some of the pain that mothers and families experience. The credit cannot be used when the mother voluntarily induces the termination of the pregnancy or does not experience at least 20 weeks of gestation.

After hearing the testimony of two mothers who lost children during pregnancy, committee members passed the bill without debate.

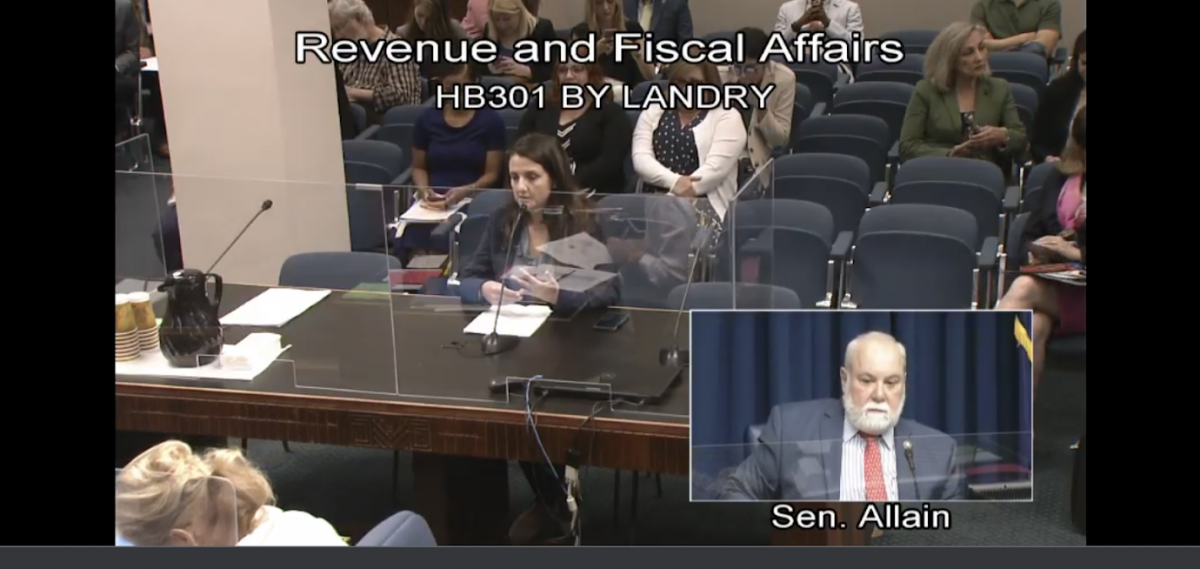

A bill by Rep. Mandie Landry, D-New Orleans, also advanced through the committee. HB 301 creates a refundable tax credit for burial expenses if a woman dies from pregnancy complications.

There were 29 pregnancy-related deaths in 2016 and 2017, according to the Louisiana Department of Health.

If the bill is passed by the Senate, the individual paying the funeral costs could claim up to $5,000 for items such as caskets, plots and funeral services. The refund would not cover flowers, urns or vaults.

The credit could be utilized when the mother dies while pregnant, during labor or from complications up to one year after childbirth.

PHOTO CAPTION: Rep. Mandie Landry testified Wednesday about her bill to create a refundable tax credit for burial expenses if a woman dies from pregnancy complications.