Two Louisiana Projects Among Finalists in EDA’s $1 Billion ‘Build Back Better’ Challenge

December 14, 2021

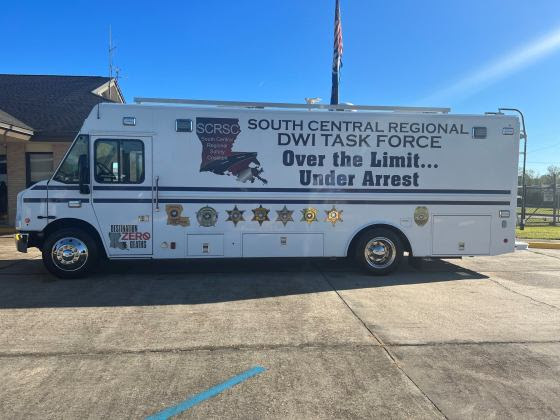

2021 Holiday Season Drive Sober Or Get Pulled Over Campaign

December 14, 2021Insurance Commissioner Jim Donelon participated in a meeting organized by GNO Inc. Monday morning to advocate for greater transparency on the new flood insurance rates in the National Flood Insurance Program (NFIP) that will take effect for renewing policies on April 1, 2022.

The NFIP launched Risk Rating 2.0, a program that dramatically changes how flood risk is assessed and priced, on Oct. 1 for new policies. The new rates for existing policyholders begin taking effect on April 1 as policies come up for renewal. Risk Rating 2.0 aims to make the NFIP more actuarily sound by looking at the construction style and location of individual homes and their proximity to water rather than by relying on flood zone maps. Many people in flood-prone states like Louisiana have expressed concern that there is not enough information about the potential financial impact of the new rating scheme.

“Louisiana property owners are already facing major expenses while rebuilding from four hurricanes that hit our state in the span of one year and two days,” Commissioner Donelon said. “We need to know how much NFIP premiums will rise under Risk Rating 2.0.”

GNO Inc. organized Monday’s meeting of the Coalition for Sustainable Flood Insurance (CSFI), a national coalition of business associations, economic development organizations, government entities, and consumer groups lobbying for a long-term reauthorization of the flood program and stronger limits on how much premiums can rise each year as Risk Rating 2.0 is implemented. CSFI would like to see greater transparency in how different factors are weighted in the new NFIP rates, how those rates were developed, and what the rates will ultimately be when all risk has been factored in, including projected rates into the future subject to unforeseen changes that might alter such projections.

Monday’s meeting took place at the Home Builders Association of Greater New Orleans and included stakeholders who participated remotely from Galveston, Texas, and Key West, Florida, as well as other areas affected by the new rate plan.

Currently, the NFIP is authorized to operate through Feb. 18, 2022.