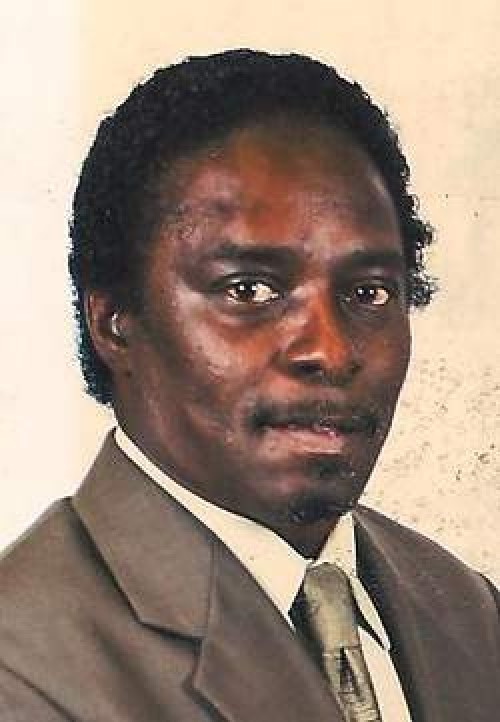

Vincent Jupiter Jr.

January 10, 2011Dream alive at local Functions

January 12, 2011Drivers in the Tri-parish region were slowed at the pump when prices hovered around $3 a gallon as the New Year arrived. During the final week of December 2010, the average U.S. retail price on all gasoline grades had increased by about 7 cents from the previous week.

“I don’t like it at all,” said Abby Smith of Houma as she watched the dollars spent increase while she filled her vehicle with gasoline priced at $2.96 a gallon.

A sudden jump in prices at the pump caused some consumers and industry insiders to wonder if it was a sign of things to come and if rumors of $5 a gallon gasoline could be a permanent reality in 2011.

Shell Oil President John Hofmeister went on record when he predicted that Americans would be paying $5 a gallon by 2012. At the same time, some investment banks insisted that the cost of crude oil would push past $100 a barrel and stay there not only because of consumer demand at the pump but to cover heating homes and supplying the public with other durable goods.

On the other hand, local industry experts cautioned against panic and said there are many factors that must come into play before crude n listed at $89 a barrel at noon on Dec. 30 n would jump to more than $100 a barrel for the first time since the summer of 2008 and push to just over $102 a barrel to translate n once taxes and other cost additives were included n to approximately $5 a gallon at the pump.

Historically, gasoline prices adjust more than a week after changes are made to the crude oil index. But during the past several weeks, observers noticed a narrowing of that gap as retailers posted higher prices to keep up with market projections.

On the final day of 2010, national averages saw that regular unleaded gasoline sold for $3.07 a gallon and diesel was listed at $3.31 a gallon.

A sampling on a regional level saw that the Plantation Truck Plaza in Houma sold regular unleaded gasoline at $2.96 a gallon and diesel at $3.11 a gallon. Retail prices at the Acadia Truck Plaza in Thibodaux were $2.93 for regular unleaded and $3.19 for diesel. And the Jubilee Chevron station in Franklin listed regular unleaded at $2.99 a gallon while diesel sold for $3.19 a gallon.

Area financial advisors said, responding to the pricing activity, that the overall economy will influence crude and pump prices more than futures traders at a stock exchange.

“If the economy improves, the demand for oil will go up, which will increase the price,” Ameriprise Financial advisor Lloyd Kern said from his office in Thibodaux.

Houma Morgan Stanley resident manager Arlen Ledet added to that thought when he said, “At 10 percent [approximate national] unemployment you’re not going to have a lot of real growth.”

Both men said that the domestic economy and currency value are key factors in what might happen to crude prices and how that translates at the pump.

For Kern, much depends on what happens to the value of the dollar in a global market. “A barrel of oil is priced in dollars around the world. So the weaker the dollar gets, the higher the price of oil you get. [That] change turns into high gas prices,” he said.

Kern offered a prediction that the dollar would weaken during the New Year as low interest rates and budget deficits n along with other countries diversifying currency away from the dollar n impact domestic economic conditions.

“The oil that we drill in the Gulf is important for us to build our reserves, but it is also important for our jobs around here,” he said. “The bottom line is we’re going to have to drill in deepwater no matter what Congress says unless they want to be held hostage to countries overseas.”

Ledet said he was not concerned about what he called an “artificial bump for the holidays” regarding pump prices.

“People are going to complain just like they always do, and futures are going to go up and drive up the price of crude. So, during the summer months [just as had been experienced during the Christmas season] we are going to have artificially high gasoline prices again. It happens all the time. I think we are in the same old pattern,” he said.

Kern and Ledet said impact from the Deepwater Horizon explosion and spill, a federal moratorium on deepwater drilling, a de facto ban on shallow water drilling by the slowing of permits, and the government calling off lease sales would have minimal overall influence on the cost of fuel at the pump.

“[Government officials] are pinned up with the demand for permitting and drilling, but they will have to get through the process that is bottlenecking right now,” Ledet said.

“There is uncertainty,” Kern said. “I think it is important that we do drilling in the Gulf. Not only to the American consumer, but to us for our economic survival down here.”

Industry experts admitted that events of 2010 taught them to expect the unexpected, and claim that increased commerce activity during 2011 would be more reflective of businesses becoming weary of worry following the past two years of recession than anything related to oil and gas production.

More activity would increase demand. For oil producers increased and steady prices could offer an economic boost. For drivers it could mean paying more at the pump at least during holiday and vacation seasons when demand increases. For everyone it remains a matter of waiting to see what will happen.

Abby Smith of Houma watches the dollars spent increase while filling her tank at $2.96 a gallon. Industry experts warn of pump price jumps during 2011. MIKE NIXON – TRI-PARISH TIMES