TPSD moves toward tax proposition

May 13, 2014

WRRDA committee approves Morganza

May 13, 2014A federal provision that made it impossible for new homebuyers to absorb a property’s existing flood-insurance policy has been repealed and the federal government has reverted to old insurance policy rate tables, as the Congressional fix to what was a looming coastal calamity was significantly implemented last week.

The so-called sale trigger in theory would stall the housing market as potential sellers watched their property value decline because it was quantifiably less valuable to potential buyers than it was to them, and as potential buyers were scared off by higher rates mandatory in order to maintain a mortgage.

U.S. Sen. Mary Landrieu last week announced the Federal Emergency Management Agency had formally rescinded that provision. The repeal was set forth in the Homeowner Flood Insurance Affordability Act, the celebrated undressing of the 2012 Biggert Waters Act.

“The elimination of the property sales penalty will restore confidence in the real estate market and allow up to 82,000 middle class families in Louisiana to continue living where they work to produce the goods and products necessary for continued economic growth,” Landrieu, a Democrat, said in a press release.

Biggert-Waters was drafted as a reform bill that aimed to stabilize finances of the National Flood Insurance Program, but it posed unanticipated and disastrous consequences to south Louisiana and communities throughout the coastal U.S.

Had the insurance premiums skyrocketed as forecasted, foreclosures would have followed for homeowners unable to keep pace, bank officials said, and many coastal residents would have effectively been priced out of their communities.

The Homeowner Flood Insurance Affordability Act, signed by President Barack Obama in March, would alleviate many of the concerns. It permanently reinstated grandfathering of policies, provided safeguards against sharp rate increases, and refunded money to people who paid the higher rates within the two-year period. To help with the program’s solvency, the new law also introduced a surcharge for all policies.

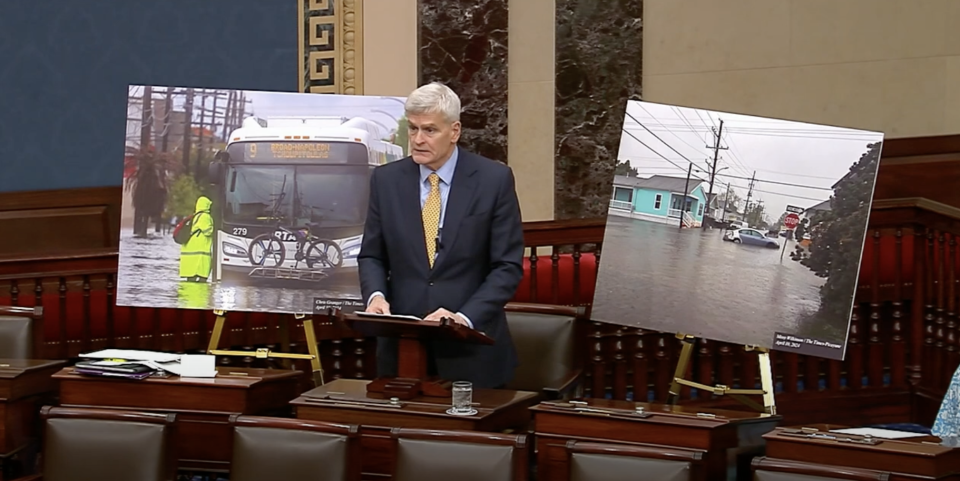

FEMA officials also revealed new rate tables that conform with the new law during a meeting with the Congressional Home Protection Caucus. Homeowners that continue to see excessive rate increases should contact their insurance companies, said Rep. Bill Cassidy, R-Baton Rouge, who chairs the caucus.

“There have been a lot of changes to the National Flood Insurance Program in the past few months, but it looks like FEMA’s implementation of the Homeowner Flood Insurance Affordability Act is moving in the right direction,” Cassidy said. “I will continue to make sure Louisiana policyholders are treated fairly and that they start seeing flood insurance relief as soon as possible.”

Implementation of the fix had been slow, according to criticisms Landrieu and U.S. Sen. David Vitter, R-La., who in an April letter to FEMA Administrator Craig Fugate said policy holders who would have been saved by the fix are still being charged rates set by Biggert-Waters due to a lagged recalibration.

“Sometimes FEMA needs a little coaxing to get things right,” Vitter said.

Terrebonne Parish President Michel Claudet said the “slower than slow” rollout of the new rates forced difficult, expensive choices on coastal homeowners that should be exempt from the lingering impact.

“FEMA, its normal self, has not actually taken all of (the insurance fix) into effect,” Claudet said. “It’s my understanding that they should refund (the difference) at a later date.”

Still, Claudet said, if homeowners are charged the incorrect rates and have the means to pay them, they should do so, particularly considering the proximity of hurricane season.

“As much as I’m sorry to say this, if they can possibly afford paying it, I think they should pay it and make sure they follow up on the refund,” he said.

FEMA officials also told the caucus progress has been made in efforts to determine how to factor levees and other flood-control materials that don’t meet federal standards into flood-zone maps, Cassidy said. Should FEMA give full or partial credit to these structures, affected homeowners would see their premium costs decline.