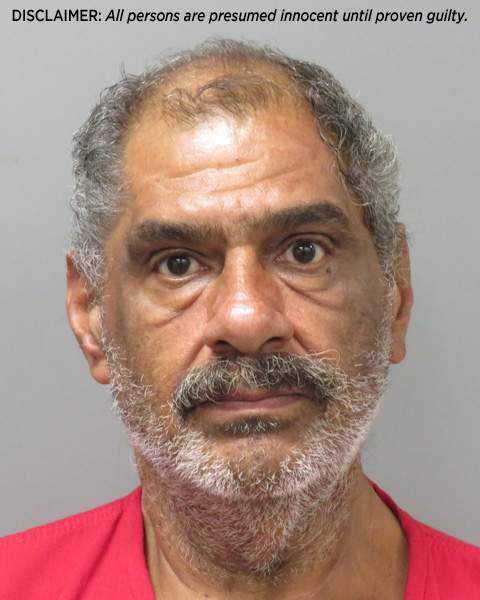

Golden Meadow Man Confesses to Oral Sexual Battery

March 2, 2023

New ADA compliant playground at Peltier Park complete

March 2, 2023Sen. John Kennedy (R-La.), a member of the Senate Banking, Housing and Urban Affairs Committee, introduced two bills to lower flood insurance premiums for Louisianians. The Risk Rating 2.0 Transparency Act would require the Federal Emergency Management Agency (FEMA) to publish an explanation of how the agency is determining flood insurance prices under Risk Rating 2.0. The Flood Insurance Affordability Act would cap annual flood insurance premium increases.

“The Biden administration is refusing to show lawmakers the new algorithm it uses to raise flood insurance premiums. Since millions of Louisianians depend on the NFIP to protect their homes from natural disasters, FEMA must come clean about why premiums are skyrocketing under Risk Rating 2.0. In the meantime, my bills would ensure fairer rates for the people of Louisiana,” said Kennedy.

Sen. Cindy Hyde-Smith (R-Miss.) cosponsored the Risk Rating 2.0 Transparency Act.

“At a minimum, policyholders deserve to know exactly why their premiums cost as much as they do, especially when that rate is higher than previous years. From the start, FEMA has not been forthcoming with the public or Congress on how it developed the new flood insurance rate structure. This bill would ensure FEMA transparency surrounding Risk Rating 2.0, so homeowners aren’t left in the dark,” said Hyde-Smith.

Under FEMA’s Risk Rating 2.0, Louisiana homeowners expect to see an estimated 122% increase in their flood insurance premiums.

The Risk Rating 2.0 Transparency Act would make FEMA responsible for creating an online data base for policyholders under the National Flood Insurance Program (NFIP). The database would provide information on premium rates and how FEMA sets those rates.

Sen. Marco Rubio (R-Fla.) cosponsored the Flood Insurance Affordability Act.

“Flood insurance is vitally important to Floridians and Americans living in coastal communities. People shouldn’t have to pay an arm and a leg to make sure they are protected. This legislation is common sense,” said Rubio.

The Flood Insurance Affordability Act would lower the statutory limit on annual premium increases on primary resident homeowners under Risk Rating 2.0 from the current limit of 18 percent to nine percent.