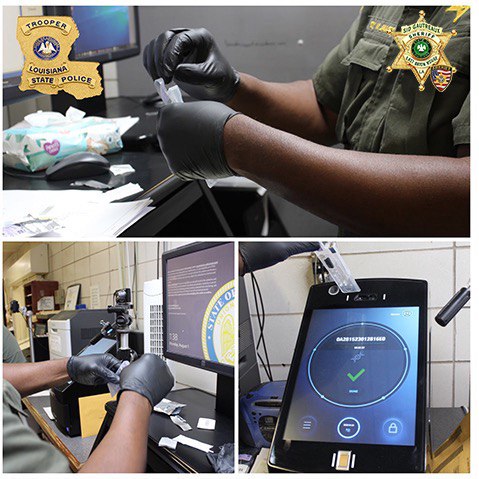

LSP Crime Lab Implements Innovative DNA Technology

August 6, 2022

Louisiana Red Cross issues safety tips as students return to school

August 7, 2022Commissioner Jim Donelon announced the Louisiana Department of Insurance (LDI) helped consumers collect over $129 million in payouts in addition to the original amounts offered by insurance companies in Fiscal Year 2021-2022.

The additional money is the result of consumers filing complaints with the LDI Office of Consumer Services, which has staff members who review consumer complaints and work with company representatives to resolve disagreements.

“Our Office of Consumer Services staff are hardworking and compassionate in their efforts to help policyholders get the answers they need and the money they deserve,” Commissioner Donelon said. “Although we are approaching the peak of the 2022 hurricane season, our office has not forgotten about those still struggling after Hurricane Ida and the 2020 hurricanes that impacted our state. If you’re having issues with your insurance claim process, contact us for help.”

The LDI received 8,819 complaints and helped consumers recover $129,057,866 in additional payments from insurers between July 1, 2021, and June 30, 2022. Hurricane Ida accounted for the majority of the funds recovered through the complaint process with 4,924 complaints and $100.6 million in recovered funds.

The recovered funds come from formal complaints regarding property and casualty, health and life and annuities products. Information on complaints and funds recovered in Fiscal Year 2021-2022 are broken down as follows:

Consumer Insurance Dispute Settlements Between July 1, 2021 – June 30, 2022

| Insurance Product | Complaints Filed | Funds Recovered |

| Health | 658 | $304,941 |

| Life & Annuities | 322 | $2,864,114 |

| Property & Casualty | 7,839 | $125,888,811 |

| Total | 8,819 | $129,057,866 |

When the LDI receives a complaint, a trained specialist listens to the consumer’s account of a problem, contacts the company on their behalf, investigates the situation and determines whether the company adhered to Louisiana law and the provisions of the consumer’s policy.

Insurance consumers can file a formal complaint by submitting a paper form or visiting www.ldi.la.gov/fileacomplaint. Louisiana policyholders may also meet with consumer services staff at the LDI in Baton Rouge to discuss their issues and file a complaint if warranted.

Policyholders who file a complaint will be given the name of the examiner assigned to their case and a tracking number to check the progress of their case online. The average complaint takes 45 days to fully investigate, depending on the complexity of the case.

The LDI also has an online feature where consumers can view the number of complaints filed against companies who write insurance in Louisiana. Complaint data sorted by company name, premium written and the complaint index, which measures complaints for a company relative to the amount of premium written, is available at www.ldi.la.gov/complaintdata.

Consumers with questions or complaints may contact the Office of Consumer Services by calling 1-800-259-5300.