Free state park visits added to vaccine incentives campaign

June 4, 2021

Mandatory kindergarten bill passes House, heads to Senate for final passage

June 4, 2021By Matthew Bennett and Adrian Dubose, LSU Manship School News Service

The Legislature gave final approval Thursday to a bill to streamline sales tax collections, while the House refused to extend $180 million in tax credits for the movie industry, at least for now.

The Senate also voted to extend the suspension of the corporation franchise tax on the first $300,000 of capital for small business corporations with taxable income of $1 million or less. The measure could cost the state $313.5 million in revenue over five years.

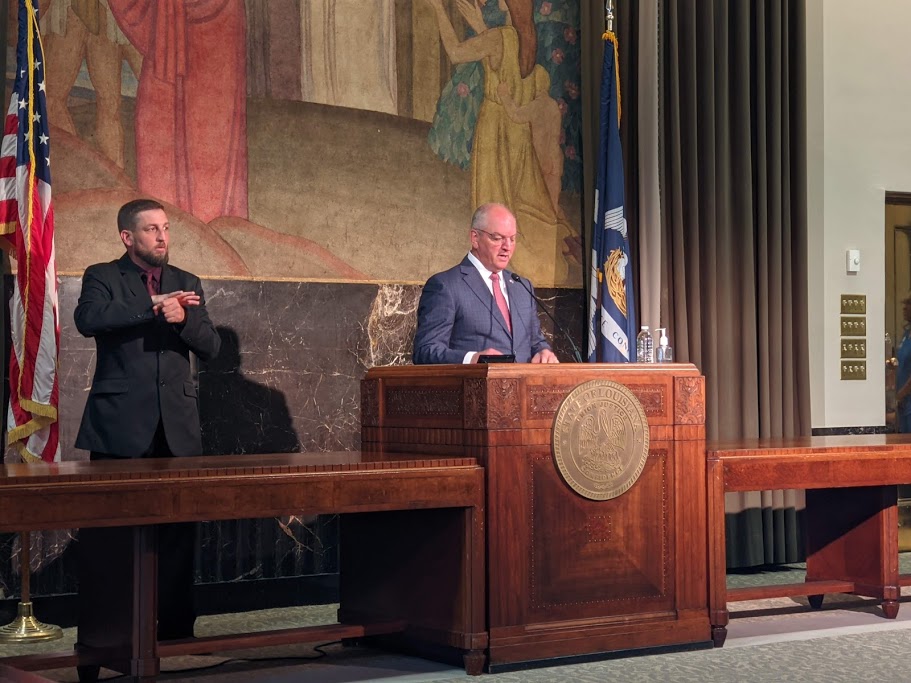

The push to streamline sales tax collections was led by House Speaker Clay Schexnayder, R-Gonzalez. The goal was to create one body to collect both the state and local portions of the sales tax, simplifying the payment process for businesses, and then distribute the money to the various jurisdictions.

Schexnayder’s bill, HB 199, would require a constitutional amendment approved by state voters. It would then create the State and Local Streamlined Sales and Use Tax Commission, comprised of eight members, to oversee the effort and make the collection process as simple for businesses as it is in many other states.

“We’ve been trying to get this done for nearly 40 years and today we did it,” Schexnayder said in a statement. “Removing this roadblock is the critical first step in turning our state around and bringing good, high-quality jobs for our people. Today was a big day for Louisiana.”

Also on Thursday, the House voted 45-37 against extending the sunset date for the movie industry tax credit.

The Motion Pictures Production Program provides state-certified film and TV productions with up to a 40% tax credit on in-state expenditures. The program can issue up to $150 million in credits per fiscal year, and recipients can claim up to $180 million per fiscal year.

Senate Bill 173 by Sen. Sharon Hewitt, R-Slidell, was to extend the sunset date of the credit from 2025 to 2028.

Twenty-three members were absent for the vote, so the bill could be brought up again before the session ends next Thursday.

Some lawmakers argued that the tax credit helps the state tourism industry and small businesses.

Rep. Barry Ivey, R-Central, said he opposed any instruments that would diminish the movie tax credit program. However, he pointed out that most of the companies that used the credit were based out of state.