Raceland Man Charged with Rape of Two Juveniles

September 29, 2022

Terrebonne Council on Aging to host Parish-Wide Bingo

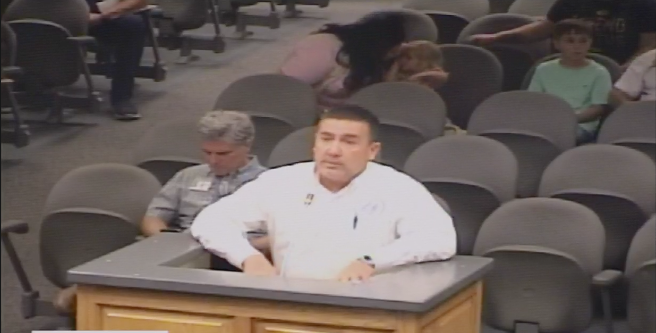

September 29, 2022Terrebonne Parish Assessor Loney Grabert delivered tax roll updates at last night’s Terrebonne Parish Council.

Grabert reported there are no appeals for tax season 2022. Last year, Grabert did a blanket approach reduction of 10 and 15 percent, and he explained that it went back onto the roll for this year. He explained that means residents’ values went to what it was before Hurricane Ida. “If you get any calls because the taxes went up,” he advised council members, “I didn’t do a re-approval, I went back to what they should have been prior to the storm.”

He reported that they are still down on tax rolls about $5.5 million from 2020. Grabert explained that most of the loss is on inventory, machines, equipment, furniture, etc. He said they did report some loss on lands, but not as much as the parish had seen the year prior. “When tax bills go out,” he said, “I will be sending letters out again for those who still have construction going on to come in and see me so we can re-value those types of buildings,” he concluded.

As the assessor, Grabert is required by the Louisiana Constitution to list and value all property subject to ad valorem taxation on an assessment roll each year. Terrebonne Parish Assessor’s Office must appraise and assess approximately 50,000 parcels of property. Property is assessed as follows:

- Land: 10% FMV

- Residential Improvements: 10% FMV

- Commercial Improvements: 15% FMV

- Personal Property: 15% FMV

- Public Service Property: 25% FMV

The assessor does not raise or lower taxes and does not make laws that affect property owners. According to the assessor’s website, the Constitution of the State of Louisiana, as adopted by the voters, provides the basic framework for taxation, and tax laws are made by the Louisiana Legislature. The rules and regulations for assessment are set by the Louisiana Tax Commission. The tax dollars are levied by the taxing bodies, such as the council, school board, etc., and are collected by the Sheriff’s Office as Ex-Officio Tax Collector

If services are needed, call (985) 876-6620. The Terrebonne Parish Assessor’s office is open to the public and is located at 8026 Main Street, Suite 501, in Houma. Please enter using Gabasse Street. Office hours are Monday through Friday from 8:00 a.m. to 4:00 p.m. Visit https://www.tpassessor.org/ for more information.

To keep up with council meetings, follow Terrebonne Parish Council on Facebook. Visit tpcg.org/council to download meeting agendas.