Landry seen as underdog to Boustany

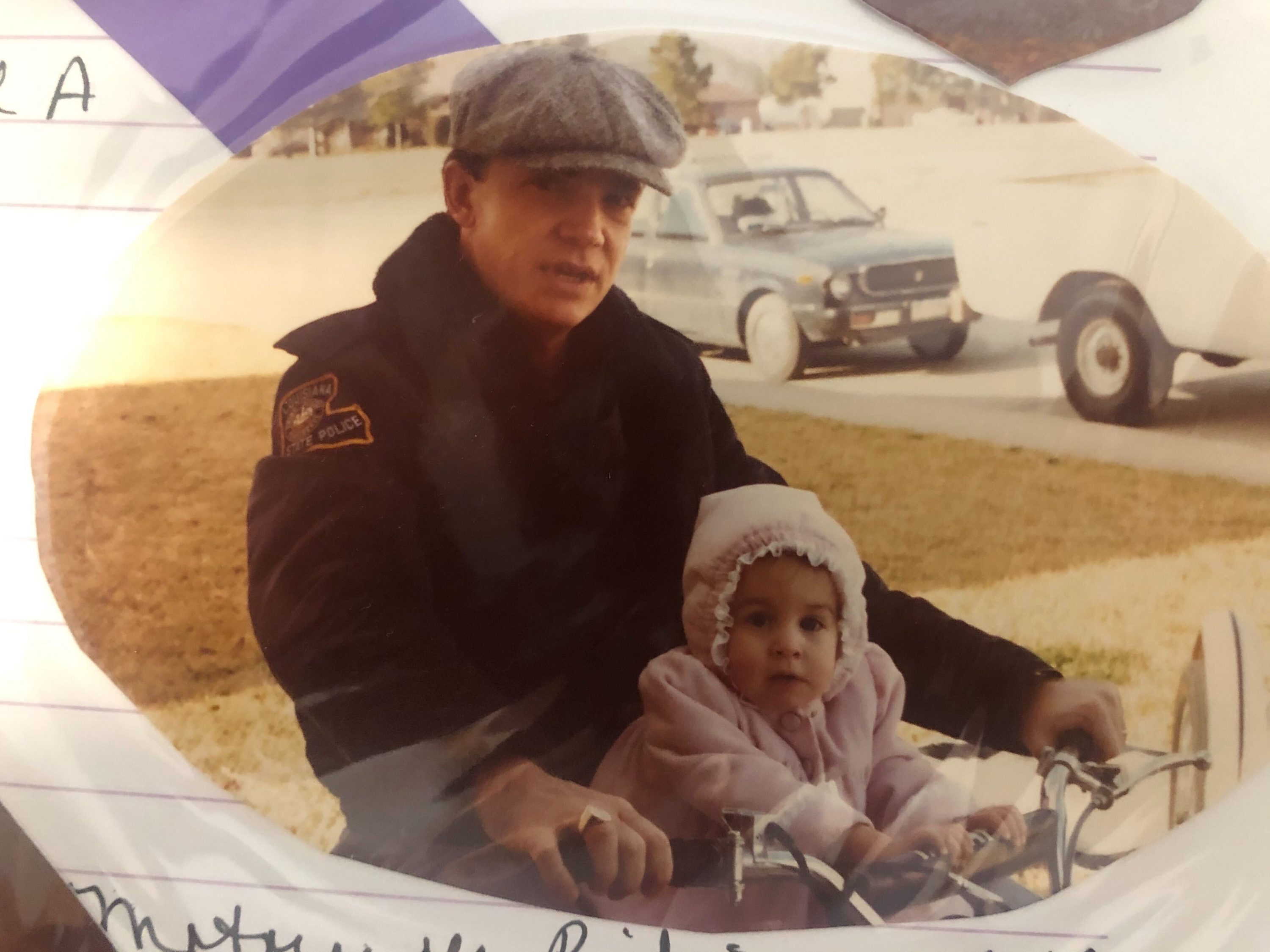

February 7, 2012Joseph Clovis Autin

February 9, 2012It is that time of year again. Individual filers and business owners are getting materials together for tax season. No matter how prepared they think they are, filers on all income levels are probably unprepared for what they are about to discover.

If you notice that your federal tax bill is higher this year than last, or that your return is smaller, there is a reason.

As of Dec. 31, 2011, a total of 77 tax deductions, credits and exemptions expired and can no longer be claimed.

That’s right, the alternative minimum tax exemption, IRA rollover exemption, home energy improvement credit, tuition and education fee deduction, mortgage insurance premium deduction and 72 other well-known and little known tax breaks are gone.

Like many laws, the tax benefits that a majority of taxpayers claim to one degree or another all carry expiration dates. Simply put, nothing tangible lasts forever, but who expected so many cuts in a single setting?

It is always interesting when something like this occurs on an election year, to give those running for office numbers and issues to throw at one another.

So while office seekers and incumbents are throwing numbers around and talking about how the rich and poor are each somehow simultaneously suffering, this would be a good time for Congress to begin serious talk about tax reform, including the option of a flat tax.

The research has been done. The findings are available and workable.

The basic element of a flat tax is its fairness because everyone pays the same rate without taking advantage of obscure breaks or being disappointed when deductions are no longer available.

A flat tax means that dollar for dollar an employee keeps more money in pocket at the end of the year and employers are able to reward high performance easier because they are not burdened with a multitude of obscure taxes n some of which constitute double taxation.

Tax filing becomes easy for virtually anyone, and tax preparers are freed to help their clients make money rather than putting in hours trying to simply save it.

The disadvantages, which could be overcome with creative design, include determining a single tax rate percentage that is economical to personal income of all taxpayers and establishing a funding reserve since surprise tax increases, disguised as the expiration of benefits, would no longer be available.

We believe it is time for serious tax reform. Since it comes during an election year, Congress could think about that as they complete their tax returns and contemplate their own potential expiration dates.