Longevity a central issue in Senate race

September 16, 2014

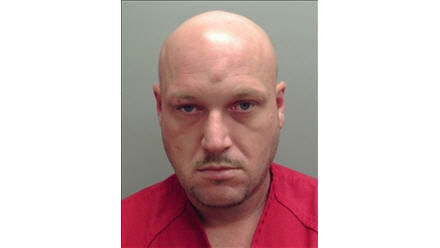

Triple-murder trial delayed

September 16, 2014The fact that health care costs are rising is indisputable.

The average health insurance premium has risen by 196 percent since 1999. Medical debt is the number one cause of bankruptcy. This year, heath care spending growth hit a 10-year high.

Reviewing the numbers, it’s not difficult to understand why employers all over the country are being asked to make changes to their health plans. The real question is how to balance the increased cost without overburdening members.

That’s the question that the Office of Group Benefits has been grappling with for years.

OGB provides insurance for 230,000 state employees, retirees and their dependents across Louisiana. And when it announced that it would make changes to its plans in 2015, questions came pouring in from members and legislators.

Why are changes necessary?

To truly understand the need to transform OGB, you have to place it in context of the health care industry as a whole.

The last time OGB made significant changes to its offerings was in 2008 when it added the current statewide HMO plan to the available options. The OGB HMO plan was exceptional from the beginning.

While traditional HMOs cover care provided by a narrow network of providers, OGB’s plan included providers in the same nationwide network as its PPO plan. While most HMOs require care to be coordinated through a primary care physician who refers members to specialists, OGB’s plan had almost no prior authorization or referral requirements.

By all definitions, it wasn’t an HMO at all. But it was priced like one.

When the HMO was launched in 2008, premiums for a single employee were $130.18. In 2015, that plan will offer premiums of $140.38. That’s a little more than a 7.5 percent increase over a 7-year period.

In that same period, premiums nationwide rose by 31 percent.

OGB’s claims rose in that time period as well. Since the HMO was introduced, claims grew from $993 million to $1.37 billion in 2014 – a 28 percent increase. However, OGB was able to shield its members from most of those increases through its shift to third-party administration and by using a portion of the fund balance to cover the increased costs.

OGB’s success at mitigating costs for its members has created false notions about of the cost of care among many of its members. While private industry and other state health plans have been dealing with rates rising at double the cost of inflation, the cost to OGB members has risen three percent slower than the annual inflation rate.

Today, though, OGB finds itself in the same situation as other employers across the country. Health care costs are still rising at about six percent a year, the Affordable Care Act is projected to cost $24 million a year, with the potential for an additional $31 million “Cadillac tax” in 2018 if changes are not made. And after two years of using the fund balance to shield members from the true cost of care, it has reached a stable target balance.

So, how does OGB manage the increased cost of health care?

When employers face rising costs, they have only a few options and none of them are popular. They can raise rates and ask employees to pay more, they can adjust benefits by shifting the cost share on certain procedures and plans, or they can spend less on administrative costs.

The plans OGB will offer in January do a remarkable job of balancing those options. While rates increased for the first time in nearly three years in July, they will not increase in January.

OGB has cut administrative costs by reducing central office expenditures and by partnering with Blue Cross and Blue Shield of Louisiana. That partnership has saved OGB $40 million over the last two years, providing relief from the rising costs.

And while there are plan changes scheduled for January, most OGB members will see minimal changes in out-of-pocket costs.

The largest change to the plans offered in 2015 is the increase to the out-of-pocket maximum.

Less than three percent of members in OGB’s HMO plan reached the out-of-pocket maximum last year. That means that for most members, the increased maximum won’t affect their bottom line.

The other major change is the addition of a $500 deductible to the HMO plan (the Magnolia Local Plus).

While the deductible only applies when a co-pay doesn’t, members in that plan will have to reach the deductible before the plan will pay a larger portion towards care.

However, in 2015 OGB will also offer new plan options that preliminary calculations show can save the majority of members money in premiums and other out-of-pocket expenses compared to their current coverage.

The new Pelican HRA 1000 provides low premiums, a nationwide network, and $1000-$2000 in employer funding that offsets half of the deductible. Once the deductible is met, the plan pays for 80 percent of the cost of care.

In a perfect world, OGB’s costs would stay flat year after year and no members would be pay any more for care than they did when they first signed up for an OGB plan. Unfortunately, rising healthcare cost trends require OGB to make changes as well.

What won’t change, however, is OGB’s history of effectively managing costs to provide its members with quality care at affordable rates.