Fertitta’s dual roles not a conflict, ethics board says

September 23, 2011

Documenting wells leads to cleanup

September 27, 2011The very elements that make the oil and gas industry a leading contributor to Louisiana’s economy are the same components that could keep the state reasonably comfortable in the coming months while other parts of the nation prepare for another financially cold winter.

On the other hand, increased federal regulations could set petroleum and natural gas activity on a slower pace as those who produce, manufacture and consume goods connected to oil and gas take a hard look at the costs and risks involved.

Varied Benefit

Diversity makes the difference, and it is difficult to find in abundance north of the Gulf Coast with the depth and breadth within one single industry that Louisiana has with petroleum and natural gas.

“All you have to do is look at Louisiana’s pipeline structure and realize that Louisiana is absolutely critical to the entire country,” Louisiana Oil and Gas Association President Don Briggs said.

As a leading voice for the business, Briggs explained that natural gas and petroleum should be described more as four industries than two parts of a whole.

Exploration and production might be the most apparent elements recognized by others looking at the Tri-parish region, but with 19 active Louisiana refineries employing more than 8,700 people and processing 15 percent of the nation’s entire raw product into usable fuel and chemical stock, manufacturing becomes an important part of the mix.

Marketing leads to outlets such as service stations to fill motor vehicles and utilities that run and maintain pipelines and carry gas for cooking, heating and manufacturing in homes and businesses. Many electrical processing plants across the nation would not function without natural gas.

Finally, Briggs noted the transportation sector, tankers delivering crude from recovery locations under the sea floor, to a network of pipelines that route a flow of product across the land, to on-land transport vehicles which both consume the product and deliver goods, that have one way or another been made, processed or packaged in part because of petroleum, definitely is part of the mix.

By the Numbers

During May, national gasoline prices at the pump averaged $3.97, but had dropped back to $3.57 per gallon by September, because of a market decline in crude prices. Those same pump price averages are expected to decline to $3.47 a gallon by the end of this month.

In August, the U.S. Energy Information Administration predicted that refinery costs for crude oil would increase to an average of $100 per barrel by the end of 2011, and reach $103 by 2012. During that same month, natural gas inventories were listed at 3 trillion cubic feet. This was below usage levels from the same time one year earlier. That market is expected to tighten by the end of the year.

Last week, the International Energy Agency forecast that global oil consumption will slow during the remainder of the year. The organization reduced its global demand rate estimate by 160,000 barrels a day to 1.04 million barrels and held back on 2012 demand growth estimate by 190,000 barrels per day to 1.42 million barrels per day.

In addition to Louisiana being the third leading producer of natural gas and fourth top petroleum producer in the nation, it is the gateway that receives U.S. delivery of both offshore domestic and imported crude.

Economist Loren Scott estimated that the total direct and indirect impact of oil and gas on Louisiana stands at approximately $65 billion. He explained during an August presentation in Houma that the direct impact of the industry is witnessed through outlets such as salaries, taxes and fees spent directly by the industry. Indirectly, some salaries and expenditures are utilized by oil and gas company employees and service providers to conduct business with other companies.

Louisiana refineries alone spend more than $17 billion a year on wages, taxes and vendor services, according to the Louisiana Mid-Continent Oil and Gas Association. Nearly 48 percent of refinery vendors make more than 25 percent of their income from the refinery business.

Industry Challenged

One of the hardest blows to the oil and gas industry since the April 2010 BP disaster was not that event in itself, but the subsequent drilling moratorium placed on offshore operations by the federal government, a host of new rules and regulations issued by the Bureau of Ocean Energy Management Regulation and Enforcement, and a delay in returning the issuing of permits to pre BP spill levels.

Last week, BOEMRE announced a new offshore safety rule identified as the Safety and Environmental Management Systems rule, identified by industry insiders as just another change to another way to manage safety operations at all oil and gas facilities.

“This proposed rule is the latest regulatory reform we have undertaken to enhance the safety of offshore energy operations,” BOEMRE Director Michael Bromwich said in a printed statement. “The protection of human life and the environment are top priorities for BOEMRE. Implementing a comprehensive program with these additional features will further our goal of avoiding accidents that may result in injuries, fatalities and serious environmental damage.”

The SEMS rule adds to existing requirements for conducting job safety analysis, implements a stop work authority, tells how to identify a work and safety decision maker on site, gives procedures in reporting unsafe work conditions and carries the requirement of third party safety audits. The details are still being sorted through by industry leaders.

“We still don’t know how everybody is going to be able to react to all that stuff that BOEMRE is putting on us,” Briggs said. “And we don’t know about insurance caps.”

Speculation Doubted

The challenge for oil and gas, according to those working in the field, is not the market, but the doubts that have been placed in the minds of many because of federal tightening of activity.

“If you had $100 million, would you want to invest it in the Gulf of Mexico right now?” Briggs asked. “I’d be scared to death to do it. That’s the problem.”

Briggs said that even with the supportive data and diversity that Louisiana has to offer, a cloud of uncertainty will require a change in how business is conducted.

“The permits are being held up,” he said. “We still have complications in shallow water. And those guys are still trying to recover from insurance costs because of hurricanes we had the past five years.”

Prospects Positive

As the leader of LOGA, Briggs said even in the face of uncertainty he remains positive about the future because Louisiana, as such, is an energy business. “I know that is a very simplistic answer, but it is the reality of it all,” he said.

Briggs stressed that oil and gas produced, refined and marketed from Louisiana are critical to the U.S. infrastructure of commerce in its many forms. “It’s not going to be replaced in any or our lifetimes,” he said. “Have we seen some ups and downs? Yes we have, but we’ve got more rigs working across the United States today than we have had in decades. Right now, we are actually going through an upswing.”

Many of the elements that have caused oil and gas to experience ups and downs during the past 17 months are expected to turn in its favor and become the very components that keep this diverse industry stable.

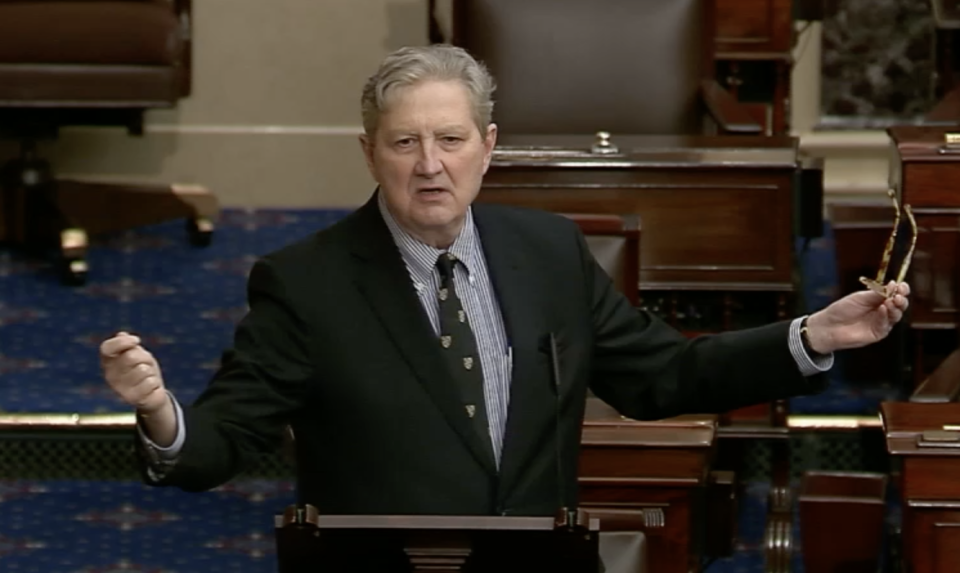

After the Deepwater Horizon explosion, locals whose livelihood was impacted by the disaster packed forums to remind officials of the harm caused to Tri-parish jobs. FILE PHOTO