Ladies: College Scholarship Applications Being Accepted for WBA!

March 24, 2022

Men’s Christian Ministry to Host Fishing Event

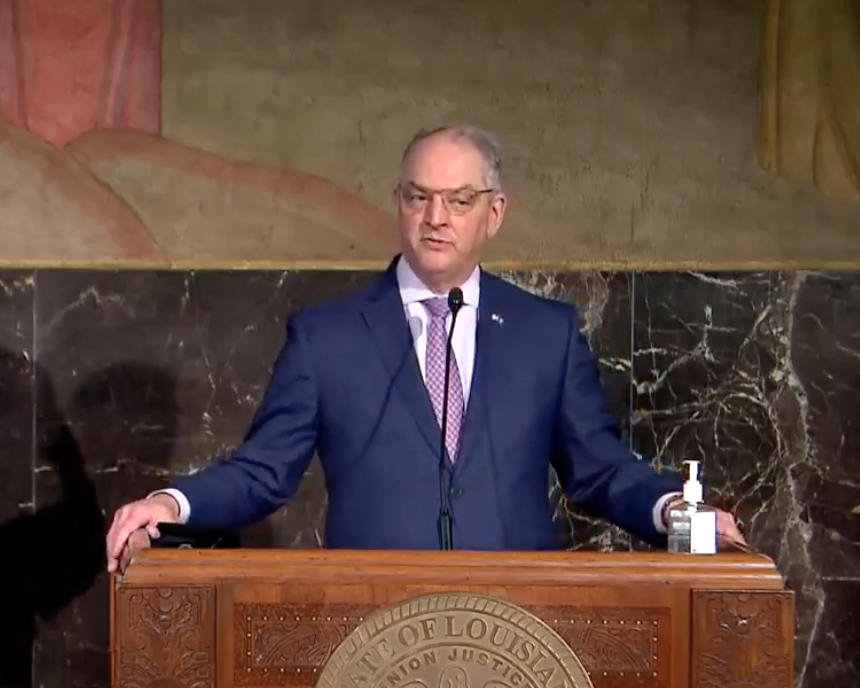

March 24, 2022Gov. John Bel Edwards will be joined by local leaders, legislators, homeowners, and business owners today to discuss the challenges facing people still fighting with their insurance companies following the 2020 and 2021 hurricanes and how key legislation can reform how insurers treat Louisianans after natural disasters.

“I’ve said it before and I’ll say it again – after a natural disaster, it’s unacceptable that many Louisianans are more scared of their insurance companies than the storm itself,” Gov. Edwards said. “It’s simply unconscionable that homeowners must fight through constantly changing adjusters, lack of response, and fine print that hikes their deductibles, just so they can rebuild what is theirs. After a hurricane, our people have enough to worry about without having to be concerned that their insurance companies will simply leave them stranded in an endless cycle of claims denials.

“Fortunately for home and business owners who are still trapped in insurance purgatory, unable to rebuild and fully recover, there is bipartisan support and momentum for meaningful insurance reform in this legislative session. I look forward to working with legislators in this fight to get our home and business owners out of this desperate situation.”

The Governor will participate in discussions in New Orleans and Larose tomorrow, and at an event in Lake Charles in the future, with home and business owners.

Key Insurance Bills in the Governor’s Legislative Package

The Governor supports the following bills on insurance reform, but will not limit his support to these items.

HB 317 by Representative Matthew Willard and SB 150 by Senator Jay Luneau would require insurance companies to not only provide information as part of a homeowner’s insurance policy about any named storm, hurricane, wind, or hail deductibles but that the form be provided and signed by the insured before any agreement changing the amount of any deductible.

HB 316 by Representative Matthew Willard would require that insurance companies provide information and documentation about a homeowner’s claim in a timely manner so that homeowners can better understand what is happening with their claims.

HB 692 by Representative Ed Larvadain III would create a Louisiana Named Storm Insurance Fraud Prevention Authority, which would be charged with enforcing Louisiana’s existing insurance fraud laws.

HB 682 by Representative Chad Brown creates an adjuster registry, which would be a database of registered insurance adjusters to help policyholders confirm that their insurance company has sent them a qualified adjuster.

HB 805 by Representative Kyle M. Green, Jr. creates regulations for how a mortgage company disburses insurance checks to a homeowner so that funds cannot be unnecessarily withheld from homeowners trying to rebuild or repair their homes.