Diocese awarded $20M bond deal

November 28, 2006Thibodaux toy drive kicks into high gear

December 1, 2006Recently departed Charles A. Page juggled a lifetime career in the military along with his own company, establishing one of Terrebonne Parish’s oldest surviving businesses.

Charles A. Page & Sons Insurance Company opened in 1946 and is currently the second-oldest private insurance company in the parish.

In the beginning, the small insurance company was located in downtown Houma across from the courthouse. It was a two-man operation, consisting of only Charles Page himself and a service representative.

The company was successful enough to put all five of the Page children through school, and in 1983, Robert Page graduated from Nicholls State University and joined his father in the homegrown business.

According to Page, he fell in love with the business when his father Charles asked him to watch over things while his dad was called back into active duty. “I came in and fell in love with the business,” he said.

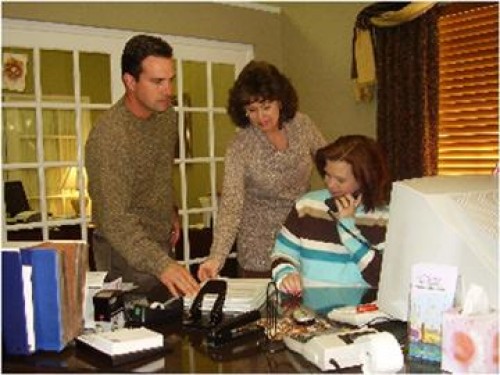

In 1986 Roberts brother, John Page joined the company after completing his degree at the University of Southern Louisiana. Shortly after he joined, the two began the process of buying out their father. Less than a year later, a whole new generation of the Page family was running the growing business. The duo quickly picked up where their father had left off.

A few years after the Page sons took over they decided to relocate the business. “Location, location, location,” Robert Page said about their new office space at 5911 Main St. According to Page, this new facility has given their company name great visibility and tremendously increased business.

Since the brothers have taken over the business, technology has changed the way they operate in a major way. When Robert Page joined the agency in the 1980s he said that it could take up to a month before a carrier would approve an insurance policy.

“Now it’s almost instantaneous,” he explained. The availability of information and the computer software have made this expedited process possible, he said.

“But insurance is insurance, it always has been,” Page said. “It’s a calculation of risk and the probability of risks occurring.”

Currently 60 percent of the company’s business comes from the commercial sector, which includes workers compensation, general liability, commercial property, business owner’s policies and life and health. The other 40 percent is made up of the private-sector policies including homeowners, auto and flood.

In the wake of hurricanes Katrina and Rita, the Page brothers have certainly seen the market change. “With respect to property insurance, everything that was in the game prior to last year’s hurricanes is now out of the game,” Page said. “It’s all a matter of availability and affordability.”

According to Robert Page, insurers definitely want to sit down and understand more of exactly what they are purchasing and what their policies contain. Page said that he and his brother spend a lot more time educating people about insurance they provide.

“Pre-Katrina, probably one out of ten actually sat down and read over everything in their policy,” he said. “Now I think more and more are understanding how important that is.”

The storms have also prompted people to invest in flood insurance.

“Flood insurance has become a hot button,” Page said. “We have sold more flood insurance policies this year than we have in any given 10-year period.”

Page said the number of flood insurance polices sold this year is approaching 2,000, and 90 percent of that business is in Terrebonne Parish alone. Charles A. Page & Son’s Insurance Agency does insure customers in other regions of Louisiana but the majority of their business is from the Tri-parish area.