Bush pardons 16, commutes drug sentence

December 22, 2006

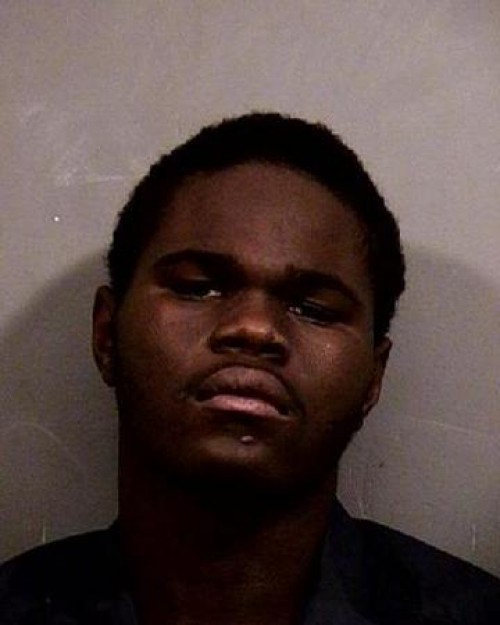

17-year-old arrested for shooting mother

December 27, 2006THE ASSOCIATED PRESS

A judge has denied a request from a homeowner to immediately block Louisiana Citizens Property Insurance Corp. from raising rates, but will consider arguments that the state’s insurer of last resort is insolvent.

State District Judge Louis DiRosa took the action in a suit filed by Calvin Gordon Sr., a New Orleans homeowner. The suit contends that since Citizens faces losses of $828.6 million from the 2005 hurricanes, the company should be considered insolvent under state insurance law.

Those losses were ultimately paid by assessments levied on insurance companies and passed on to property owners around the state through their insurance companies.

But the suit contends that asking Citizens policyholders to pay special assessments at a time when many are still waiting for supplemental claims payments would, in essence, result in customers paying their own claims.

DiRosa, who turned down a request for a temporary restraining order last Wednesday, scheduled a hearing for today to determine whether Citizens is insolvent and should be blocked from raising rates until policyholders are compensated for their claims.

Attorneys for Citizens contend it cannot be legally insolvent because it has the ability to issue bonds to cover catastrophic losses.

Last week, the Louisiana Insurance Rating Commission tabled a request to raise commercial rates by an average of 138.4 percent and homeowners by 31.7 percent.