LPSO’s Operation Crackin’ Down nets 33 arrests

January 22, 2014

Well makes for deep divisions

January 22, 2014Now that a new IRS regulation classifying mandatory tips as fees is in effect, some local restaurants along with others nationwide are eliminating the practice, because the related paperwork is too onerous.

In some cases, servers say their bosses are being less than truthful about aspects of the policy change.

However it is being handled, the new rules affect how mandatory gratuities affect not only servers and restaurant owners, but diners as well.

“Beginning January 1, 2014, the IRS began classifying the policy of adding an automatic tip to the bills of large parties of diners as service charges instead of tips,” states an advisory from the Louisiana Restaurant Association to its members. “The IRS regards service charges as regular wages, which must be reported for payroll tax withholding. The IRS ruling on automatic gratuities isn’t actually new, having been issued in June 2012 as part of an effort to update earlier tax policies on tips. Implementation was delayed up to now, however, so that restaurants and related businesses had more time to comply.”

The mandatory gratuities have traditionally been charged to ensure that servers get properly tipped when large parties dine. It prevents large groups from leaving servers with a lot less in tips than they might have earned from serving the same number of people in smaller parties.

For money left on a restaurant table or notated on a check to be considered a tip, the IRS says four factors must be met:

1. The customer’s payment must be made free from compulsion;

2. The customer must have the unrestricted right to determine the amount;

3. The payment should not be the subject of negotiation or dictated by the employer policy; and

4. Generally, the customer has the right to determine who receives the payment.

If the menu says that “an 18 percent gratuity will be added to all customer bills” or “a 10 percent gratuity will be added for all parties of six or more” then that money is regarded as a service charge, and therefore is taxable.

If that money is distributed to servers or other personnel, it is taxable income for them, according to the LRA.

The amount of the service charge also needs to be taxed on the check – to be paid by the diner – and it becomes part of the restaurant’s gross receipts.

“It is important to note that restaurants should clearly inform guests of service charges and the amount of the charge before the guest orders, either by a conspicuous notice on the menu or by some other means,” the LRA says.

Darden Foods, which owns the Olive Garden and Red Lobster chains, includes an 18 percent mandatory for parties of eight or more.

The chain is using an experimental approach, and looking at the potential of eliminating it.

According to a company spokesman, the chain halted the automatic tips in four cities, replacing them with a system that includes a choice of suggested tip amounts. Darden will make a decision at the end of the year.

Most diners interviewed this week said they don’t think the change will affect them much.

“Usually, if I go with people as a group, we get separate tickets,” said Monique Bourg, a Houma retail worker. “I tip no matter what if they do their job appropriately. It depends on their performance.”

Cristiano’s Restaurant in Houma has eliminated the mandatory charge.

“We did charge the mandatory for large groups prior to the IRS law change,” said general manager Cathy Babin. “The change makes operations difficult.”

Local servers – most of whom did not wish to be identified by name for fear of offending their employers – said eliminating the practice will cost them money. Employees at one local restaurant said they were distressed that their bosses told them the charge is being eliminated because “it is illegal” rather than telling the, the truth, that it is the restaurant’s option.

“I don’t like it,” David Verdin, a former server at Copeland’s, said of the change. “It’s not good for the industry and it’s not good for the servers.”

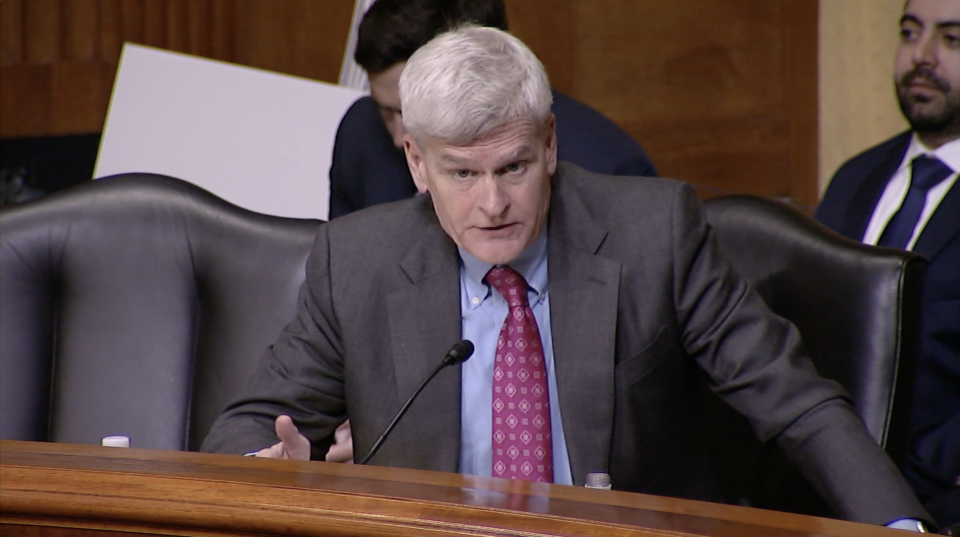

Server Jackie Stein hands a check to diner Lloyd Cooper Jr. at the Waffle House on Martin Luther King Jr. Blvd. in Houma. Diners at restaurants that charge a mandatory tip for large parties are in large part eliminating the practice due to new tax regulations.