Nicholls to Host Retirement Celebration Honoring Dr. Windell Curole

November 1, 2022

Terrebonne Parish school board candidates respond to 13 Points Education Plan

November 1, 2022Yesterday, House Republican Whip Steve Scalise (R-La.) called for greater transparency and affordability in the National Flood Insurance Program (NFIP) following a roundtable discussion where local leaders and stakeholders raised concerns about the impact of the Federal Emergency Management Agency’s (FEMA) Risk Rating 2.0 on policyholders.

For the discussion, Whip Scalise invited Representative French Hill (R-Ark.), Ranking Member of the House Financial Services Subcommittee on Housing, Community Development and Insurance, to hear directly from communities in South Louisiana about the growing challenges caused by Risk Rating 2.0.

With 80 percent of Louisiana policyholders and 77 percent of nationwide policyholders facing rate increases, data from FEMA has shown an alarming drop in policies as communities are priced out and struggle to find coverage due to a lack of affordable options.

In April, FEMA began implementing Risk Rating 2.0 for existing policies and Whip Scalise expressed his serious transparency concerns surrounding the new premium rate system and its methodology.

Whip Scalise invited Rep. French Hill to hear how Risk Rating 2.0 affects South Louisiana and other coastal communities. The roundtable included over 25 stakeholders representing key industries including flood protection, banking, home building, real estate, and insurance to explain its impact in Louisiana.

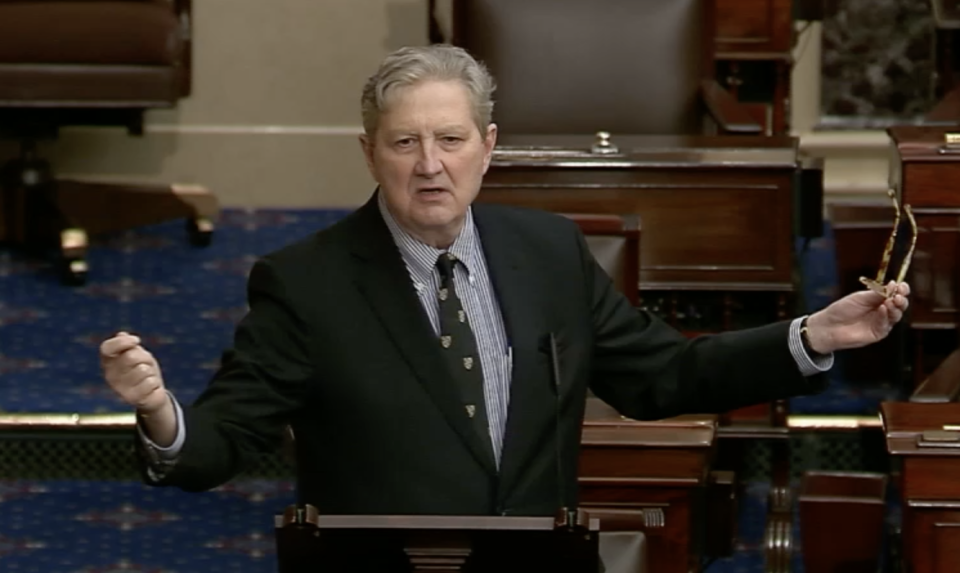

Scalise made the following remarks:

On the roundtable discussion regarding NFIP reform:

“Let’s at least have some hearings where FEMA can come and explain how they came to the decision to come up with the methodology behind Risk Rating 2.0. But I think it’s embarrassing that FEMA refuses to even meet today with people who build levees, parish leaders who invest millions and billions of dollars into better flood protection – and after they do that FEMA still gives higher premium increases and won’t explain how they came to those rate hikes. That’s inexcusable. Those are the kind of things we want to get deeper into.”

On the stakeholder concerns of FEMA’s Risk Rating 2.0:

“Number one, they (FEMA) didn’t set up a program (Risk Rating 2.0) that was going to be affordable and in fact, we’ve seen thousands of people drop their flood insurance policies just in the last year here in South Louisiana. I am sure there is a trend going all across the nation.

“FEMA initially started putting up numbers and then they pulled the data down. Why is FEMA afraid of being transparent with the results of their plan? And those are the sort of things we’d like to look into.”

On the discussion regarding long-term NFIP reform:

“If you go back to the last time we were in the majority, and I was the Majority Whip, we were able to get a five-year reauthorization passed through the House. It was a complicated coalition, not your normal-looking Republicans versus Democrats partisan issue. It was actually a very bipartisan but more regionally based coalition in the bill that we passed through the House.

“There are people and communities all across the country that understand the importance of having a viable working flood insurance program.” Watch the full video below: