Divine Intervention: Local has ties to the pope

March 19, 2013

Allain pushing for I-49 finish

March 19, 2013Gov. Bobby Jindal’s proposal to replace the state income tax with an expanded sales tax is getting favorable – though cautious – reviews from local legislators.

The concern, even among those who support the general idea, is what final shape new tax regulations will take. Most say a good deal of political give-and-take is expected, particularly in the area of what goods and services will be taxable, and how that will affect the state’s ability to stay on a sound fiscal course.

Lawmakers will begin their new session April 8. The plan would likely rank Louisiana as the state with the highest sales tax in the nation.

Jindal made his first big pitches for the plan last week before the House Ways & Means and the Senate Revenue & Fiscal Affairs committees.

“Taxing what people spend instead of what they earn gives taxpayers more control over their own money,” Jindal said, adding that eliminating income taxes will make Louisiana an ideal place for business start-ups. “ This is the best way to grow our economy and create good-paying jobs throughout the state.”

Under the plan the state sales tax would rise from 4 percent to just under 6 percent.

Tax exemptions currently enjoyed by the oil and gas industry would be cut by half.

Some goods and services not currently subject to sales tax would require a tax after Jan. 1, including some consulting, as well as dog grooming and tickets for movies and plays.

Taxes would be imposed on Internet-generated sales.

Taxes on cigarettes would rise by $1.05, from 36 cents to $1.41 per pack.

People with low incomes including retirees whose incomes are not taxable would receive rebates for increased tax expense under the program.

Alaska, Nevada, Texas, South Dakota, Washington, Wyoming and Florida have no individual income tax. New Hampshire and Tennessee have no individual income tax but do levy taxes on some personal investments.

Benefits for states with no income tax, he said, are obvious.

“Over the last 10 years, more than 60 percent of the three million new jobs in American were created by the nine states without an income tax. Every year for the past 40 years, states without an income tax had faster growth than states with the highest income taxes,” Jindal said. “Economic growth in the nine states without income taxes was 50 percent faster than in the nine states with the highest top income tax rates. Over the past decade, states without income taxes have seen nearly 60 percent higher population growth than the national average.”

Rep. Gordon Dove R-Houma said a lot remains to be seen, but that in general he supports the idea.

“It’s an opportunity to take a look at it, bring it before the Legislature and let us pick it apart,” Dove said. “We need to see what aspects of it are good and need changes but from the outside looking in is good. We have to look at how it affects people from corporations to different types of businesses, and individuals from low, medium and high incomes.”

Sen. Norby Chabert (D-Houma) has reservations but doesn’t want to lock in an opinion. The plan could take many forms before it comes before the senate, he noted.

“I think there are good aspects and bad aspects,” he said. “We are taking $3 billion off the tax roll and the question is how do you replace it? You have to do what’s right for small business and everyday folks.”

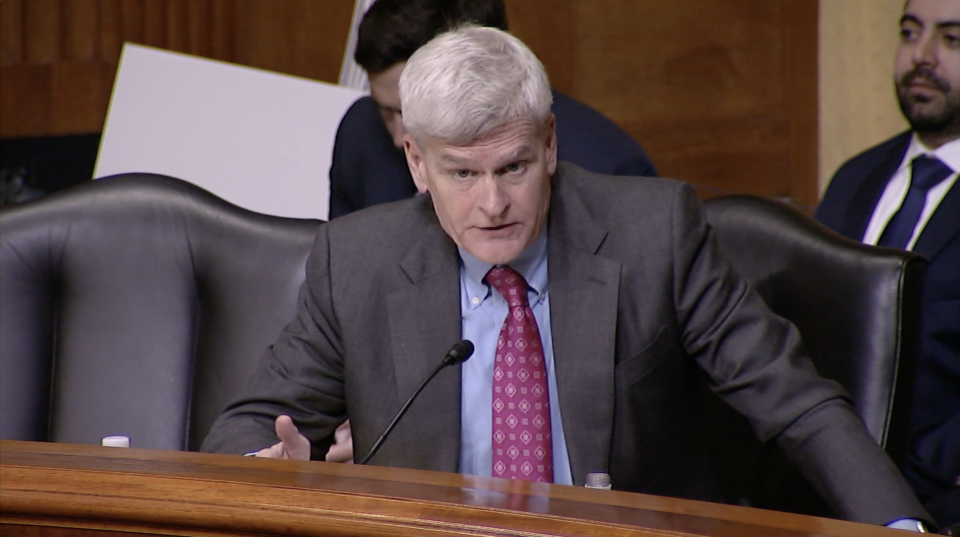

Sen. Bret Allain described his attitude as one of “wait-and-see.”

“I am real concerned about having the highest sales tax in the United States,” Allain said. “I need a little more detail to really evaluate this thing, and I don’t want to make a quick decision. I believe the state would move forward if we did away with the corporate income tax, the franchise tax and the inventory tax.”

Those taxes, Allain said, bring about $200 million into the state’s coffers. The income tax, on the other hand, brings in $3 billion, which must be replaced.

“I want to make sure we move forward and not backward,” he said.

Rep. Lenar Whitney (R-Houma) said that in general the concept appeals to her, though she will have to wait for the final product before committing support.

“I think it is better and fairer and we are just going to wait for details,” she said. “There is a long way to go before it is finalized. A lot of people are for a simpler, flatter tax structure and we will wait and see.”

State Rep. Dee Richard of Thibodaux, who has no party affiliation, also applauds the concept, which he termed “a great idea.”

But he is also aware that the devil is in the details, and a lot of details can emerge as the plan gets shaped out in Baton Rouge, as various interests wrangle their way toward a compromise, exchange favors and protect pet local industries and businesses from receiving too hard a blow.

Richard questions, however, whether such sweeping change is wise at a time when Louisiana is already facing budget problems.

Rep. Joe Harrison said it’s hard to comment just yet is not a tax plan, with no structured bill.

“There are no specifics whatsoever,” Harrison said. “To give an opinion is premature. But it goes to the core of the working middle class. They are telling me the governor has exempted them. But then who is going to pay the bill? What concerns me is it seems we are trying to please everybody. This is supposed to be a bill that addresses parity in the system, gives some relief in taxes to homeowners. But there is the business and corporate tax issue. It is a very up-in-the-air kind of proposal at this time. I don’t want to be a nay-sayer. You have to wait till you get the real specifics of what they are going to accomplish to see if it’s going to work.”

Baton Rouge economist Maurice Coates is among financial experts who have reviewed elements of the plan and see it as a valid response to Louisiana’s needs.

“Some people believe that when things are good the income tax tends to grow faster, and they would prefer to have a tax that grows faster than the economy, in order to finance government,” Coates said. “The governor and others say take position that says there is no reason for the government sector to grow faster than the economy.”

Beauty parlors, barbershops and other businesses not currently subject to sales tax will have greater responsibilities in terms of paperwork if the plan is adopted, Coates noted in a telephone interview.

“They are probably not going to be happy about that,” he said. “The new sales taxes, the new industries, they will only be charging a sales tax on the state portion. The local government taxes will not be applied to these new expanded areas.”

Could Terrebonne, Lafourche, St. Mary and other parishes expand their own sales taxes to include those goods and services for which no sales tax is currently applied?

Local officials have not yet discussed that possibility, though according to Coates and other experts they could, within the confines of what local laws allow and in the manner they prescribe.

“Nothing prevents them from taxing oilfield services, or barbershops, or others,” Coates said.