Spy with My Peculiar Eye

July 22, 2015

Underdog Story: Former Nicholls standout, Katrina survivor now a pro

July 22, 2015Investing in your or your child’s education can be one of the largest investments one will make, but financing a college education can be a frustrating process if financial aid isn’t enough to cover the costs.

Before the beginning of each semester, financial aid departments, like Nicholls State University’s, work with students to find options available based on need, classification and other criteria.

“When students apply for financial aid, there are packets for everything they are eligible for, whether it be Pell grants, state grants…,” Courtney Cassard, the university’s director of enrollment services, said. “Students are also eligible for student loans based on their classification. Freshmen are eligible for a certain amount, sophomores, juniors, seniors.”

These loans are classified as unsubsidized, which is not based on need, or subsidized, which is based on need. Whether a student qualifies for such a loan is determined by the U.S. Department of Education. A student who qualifies for a subsidized loan will have the interest accrued paid for by the federal government, as long as that student is enrolled in school. The interest accrued on an unsubsidized loan is the responsibility of the student.

Once a student reaches the financial aid limit for each academic year, parents may also apply for a ParentPLUS Loan, available to those with dependent undergraduate students. This application, done through the federal government, is based on credit and allows parents to take out additional funding, Cassard said. If approved, parents may borrow up to a certain amount dictated by the government. If declined, students may be eligible for additional unsubsidized funds.

Private loans are also available, but Cassard said this is not encouraged if students can

pay for schooling in more efficient ways. Payment plans are also available to help students manage the remaining balance by paying over time.

Large organizations that offer private funding encourage students to complete the Free Application for Federal Student Aid, available online at fafsa.ed.gov, first to see what they will be awarded and then come to them if the balance is still too much to pay out-of-pocket, Wells Fargo Education Financial Services Assistant Vice President Sylvia Jones said.

“When they get that award letter and look at the awards that are being offered, that might not be enough,” Jones explained. “Their grants, scholarships, federal student loans are capped, so that’s one of the main reasons they go this route.”

Most undergraduate students, because of low credit or little to no independent income, will need a co-signer for private loans.

Credit and other criteria are then examined by the lender of choice and applications are approved or declined based on whether the lender feels the student and co-signer will be able to responsibly pay back the loan.

“We want to make sure that the co-signer understands that if that student can’t pay back that student loan, they are taking that responsibility,” Jones said.

The amount of funding requested through private institutions, Sallie Mae Spokeswoman Ellen Roberts added, is also certified with the school to ensure students do not borrow more than the cost of attendance. The company also encourages students to make payments while in school to reduce the burden later.

“More than half of customers choose to this option,” Roberts said. “Sallie Mae’s Smart Option Student Loan features three monthly repayment options: interest-only payments while in school, a fixed monthly payment while in school or payments deferred until after school. On average, students may save almost 25 percent on total undergraduate loan costs when making interest payments while in school.”

Most private loan lenders also offer options for those at trade schools, community colleges and those seeking graduate degrees.

For Houma resident Beth Tassin, it took 13 years to pay back a $5,000 student loan, an amount she said she could have paid off much sooner had she had a more detailed plan for payoff.

“My mom made me apply for a student loan to pay for books and expenses,” Tassin explained of the subsidized loan she received as a Nicholls student. “It helped pay my tuition my last semester since TOPS ran out. I didn’t have a plan to pay it off, but I did start my payments way more than minimum amount, about $100.

“Then came a new car, shopping, a baby. Over time, I just paid slightly over the minimum and I used money I got back from an old life insurance policy I closed to pay it off.”

Whether through the school or through alternative means, it is of the utmost importance, everyone interviewed said, to borrow only what is necessary to meet educational expenses to make repayment as manageable as possible.

“It’s a big thing for us to speak to parents to explain what’s out there and available. I always tell people if there is a will, there is a way,” Cassard said. “We don’t ever want people to get overwhelmed with the process and think there’s no way to afford this.

“Usually there is a way where we can break it into smaller, palatable parts,” she continued. “We want to keep the loan debt as low as we can. We don’t want students to spend money on things outside of educational purposes. That’s something we are passionate about. We feel like if you estimate what your expenses are going to be, what your books are going to be, but you probably don’t need a lot of new toys. That’s really a priority for us.”

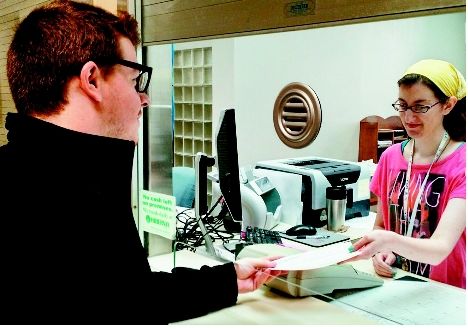

Cashier Emily Hubbell accepts a payment from Nicholls State University junior Evan Freese at the university’s Fee Collection Center in Elkins Hall.