Country Drive murder had tragic twist for children

December 9, 2015

FAST Act could provide cash for I-49, LA 1

December 9, 2015Dear Dave,

After struggling with it for several years, I finally made the last payment on my Sallie Mae student loans this week. Do you think I should ask for a formal letter stating that it’s officially paid off?

– Angela

Dear Angela,

Congratulations on finally kicking that old woman out of your house! It feels great, doesn’t it?

Sure, it couldn’t hurt anything to write and request formal confirmation that the book on your loans is closed and everything is paid in full. You can do this through email so you’ll have a record of contact, or you can send a certified letter, return receipt requested, through the post office. That way, you’ll have a record they signed for it.

Following up on paid-off debts is always a good idea, Angela. You don’t want the hassle of possibly having to deal with greedy or incompetent collectors sniffing around three or four years down the road and no way to prove you’re free and clear!

– Dave

Minor car repairs should be budgeted

Dear Dave,

My wife and I are on Baby Step 3 of your plan. When we have standard car repairs, I want to use the emergency fund. She says that kind of thing isn’t an emergency, and we should just put it off as long as possible while saving up to fix the problem. Who’s right?

– Ryan

Dear Ryan,

Sorry, you’re both wrong.

Cars break. And since no one will invent one that lasts forever and doesn’t break down, standard car repairs shouldn’t be viewed as an emergency.

Maintenance and repair of your vehicles are an ongoing expense. It’s just part of owning them.

That means you should have a category in your monthly budget for this sort of thing.

Now, an engine blowing up or the transmission going out would be an emergency. Hopefully, you’re not talking about something of this magnitude. But you’ve got to rework your budget to where you have something designated each month for car maintenance and repair. That way, you won’t be dipping into your emergency fund just to cover the basic wear and tear that comes with owning a car.

Take the next step today, and adequately fund this area so it doesn’t continually come back to bite you in the wallet and sabotage your emergency fund!

– Dave

Start saving after Step 3

Dear Dave,

I’ve been trying to get control of my money, and the other day I was looking at your plan. Where does buying a house fit into the Baby Steps?

– Stacy

Dear Stacy,

Let’s call it Baby Step 3b. Baby Step 1 is saving up $1,000 for a beginner emergency fund. Step 2 is paying off all consumer debt from smallest to largest using the debt snowball. Then, Baby Step 3 is where you top off your emergency fund with three to six months of living expenses.

Once you’ve done that, it’s time to save up for a down payment of at least 20 percent

on a house. If you take out a mortgage, make sure it’s a 15-year, fixed rate loan, where the monthly payments are no more than 25 percent of your monthly take-home pay

Doing it this way may delay your dream of being a homeowner a little bit. But buying a house when you’re broke is the fastest way I know to become a foreclosure statistic

– Dave

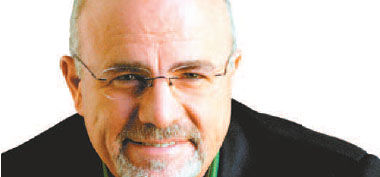

EDITOR’S NOTE:Dave Ramsey is America’s trusted voice on money and business, and CEO of Ramsey Solutions. He has authored five New York Times best-selling books. The Dave Ramsey Show is heard by more than 8.5 million listeners each week on more than 550 radio stations. Dave’s latest project, Every Dollar, provides a free online budget tool. Follow Dave on Twitter at @DaveRamsey and on the web at daveramsey.com.