Hilda Voisin Buquet

August 25, 2009

Mary Little McFarland

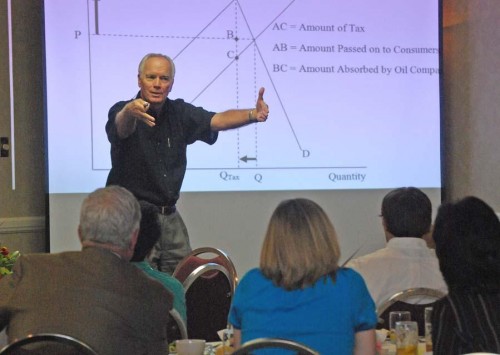

August 27, 2009Louisiana State University economist Loren Scott said the rise in unemployment in the Houma-Thibodaux area over the past several months is puzzling. “The Houma area is showing some decline in employment when it should be rockin’ and rollin’ with oil at $70 a barrel, but it’s not rockin’ and rollin,'” Scott said at last week’s South Central Industrial Association meeting in Houma.

Terrebonne and Lafourche had 2.7 percent unemployment rates in May 2008 but that figure rose to 4.2 percent for Lafourche and 4.3 percent for Terrebonne a year later. The Houma-Thibodaux area lost 520 jobs between May 2008 and May 2009.

Scott said that oil production should be profitable with oil selling at $70 a barrel. Oil is predicted to average $85 a barrel in 2010 and 2011.

Scott was more positive about the area when he discussed his report “Louisiana Economic Outlook 2009-2010” at a conference in Gray last October.

“I have really good news,” he said at the conference. “It’s a solid outlook for Houma-Thibodaux,” adding that Houma tends not to be impacted by national recessions.

“You’re hardly going to feel it in Houma,” he said at the conference.

Last week, Scott said the national recession that began in January 2008 is over, but unemployment numbers will remain high in the country for some time. Throughout the next several months, the country should see quarterly growth between 2.5 and 3.1 percent, he said.

The 2008-09 slowdown was not technically a recession because the decline was not continuous, Scott said. The economy grew 1.5 percent at one point in 2008.

“Since January 2008, we’ve had 18 months of recessionary activity,” he said, “the longest recession since the Great Depression. But it’s nothing like the Great Depression.” Only seventy-five percent of the workforce was employed during the Great Depression whereas more than 90 percent have been employed during the recent recession.

The nation’s economy has lost 6.5 million jobs since January 2008, representing a decline of 4.7 percent.

Industrial production and manufacturing dropped sharply throughout the period, but those figures may have bottomed out, Scott said.

Personal income has also fallen, but only slightly compared to the production numbers.

In contrast, Louisiana gained jobs through April 2009, adding 25,000 in 2008. For the first six months of this year, the state has had flat growth, although the construction industry added 6,000 jobs. Mississippi lost jobs three straight years and will lose them again in 2009, Scott said. Alabama had 4.9 percent job loss from 2007 through 2009.

The state compares favorably with the rest of the South partly because Louisiana is less dependent on the durable goods sector, though the state is reliant on the shipbuilding industry and its contracts with the U.S. Coast Guard, he said.

Nationally, policies coming out of Washington have exacerbated the economic decline, according to Scott. The minimum wage increase passed by Congress last month will cause demand to rise but will reduce the number of jobs, he said.

Other factors hurting job growth are higher taxes, cap and trade legislation, extreme pro-green (environmental) policies, increased regulation and prospective government-run healthcare.

In addition, anti-free trade legislation creates trade wars by levying tariffs, and pro-union policies interrupt supply-and-demand by raising wage rates above the average the process would dictate, Scott said.

Although the world could not sustain the $140 a barrel price of oil that prevailed last year, actions taken in Washington have helped to contribute to the decline in oil prices, he said.

The number of oilrigs in the Gulf of Mexico was declining already from 190 to 170 when President Barack Obama began mentioning taxing the oil industry in April.

Obama has proposed to impose $33 billion in taxes on the oil extraction industry, Scott said.

The number of oilrigs in the Gulf fell to 130 quickly following the talk about taxation, according to Scott.

Most of the taxes will be passed on to consumers through higher gasoline prices, he said. A certain amount of the increase would be absorbed by the oil companies, Scott said, but most would be paid by the companies’ stockholders. Seventy percent of oil company stock is owned by mutual funds and institutional investors holding pension plans.

The ExxonMobil refinery alone would pay $1.65 billion in new taxes, or stockholders would pay, Scott said.

The impetus to tax the oil industry is aided by popular views like one heard by Scott on New Orleans area talk radio: “Let’s lay it on the oil companies.”

The natural gas market works differently than its oil counterpart, he said. While oil prices are the same everywhere-tankers take oil to where it will fetch the highest price-the price of natural gas varies throughout the world.

The price of natural gas closed just above $3 last week, but Scott said the price is expected to average $4.50 in 2010.

The supply of natural gas is anticipated to increase as much as 5.9 percent during the next several quarters, boosted by production from the Barnett Shale field in Texas; the Fayetteville Shale field, mostly in Arkansas; and the Haynesville Shale field, mostly in north Louisiana.

Scott finished off the talk with a plea for the country to follow Adam Smith’s tenet that the best method for determining prices and the number of jobs in the economy is the supply-and-demand process.

LSU economist Loren Scott said last week in Houma that $70 a barrel oil should leave the local economy strong. * Photo by KEYON K. JEFF