Sharon Kay Lirette

September 27, 2016

Almost Famous: Colonels fall on late-game 2-point try in overtime

September 28, 2016While Louisiana’s tax code issues have remained at the forefront of employers and the Legislature for the past six months, the legislative activity has not stopped the federal government from meddling in the state’s private sector.

Many times when I talk to folks about the burdening regulations coming out of Washington, D.C., I get a look of consternation in return. They do not seem to understand what regulations are and how they influence the behavior of the private sector and their employees. Just as lawmakers in Baton Rouge and D.C. expressly enact laws to govern individual liberties, the government regulation of business affairs has the same force and impact on economic matters.

When Congress passes a law, Congress authorizes certain government agencies to create rules and set specific requirements about what is legal and what is not. Once the regulation is in effect, a given body then works to help individuals and employers comply with the law and to enforce it.

For example, when Congress passed Obamacare in March 2010, the act totaled a whopping 2,700 pages. Even among these thousands of pages, the law primarily referred to agencies – including the IRS, Department of Labor, and Centers for Medicare & Medicaid Services – to write regulations regarding most aspects of the law. Fast forward six years and Obamacare now contains up to 30,000 pages of regulations that determine which health insurance plans would remain grandfathered, and the minimum standard for health insurance plans, among other factors. Regulations have the weight of law and impact individuals and businesses of all sizes.

While the effectiveness of different rules can vary, the staggering growth in federal regulations over the years is harming smaller businesses the most. For instance, a large business may employ compliance staff to sift through regulations to determine the impact on its operations; whereas, a small firm may not have the staffing resources to conduct a thorough regulatory impact analysis.

To put it into plain terms:

The annual cost of federal regulations increased to nearly $2 trillion in 2014. To note, Congress enacted 224 laws in 2014, whereas agencies issued 3,554 rules, according to The Competitive Enterprise Institute’s 2015 “Snapshot of the Federal Regulatory State.” (http://bit.ly/29r3TdB)

In 2015, the National Federation of Independent Business released a publication showing the federal government has imposed $808.1 billion in regulatory costs on businesses since 2008. (http://bit.ly/29OR-GO2)

The Small Business Administration (SBA) estimates that every household would have owed $15,558 in 2008 if each paid an equal share of the federal regulatory burden.

The latest statistics indicate small businesses face an annual regulatory cost of $10,585 per employee – 36 percent higher than the regulatory cost of large firms.

Because of the disproportionate impact that regulations have on small businesses, they hit them the hardest. The flurried rule writing coming out of Washington, D.C. hurts job growth and stifles the economy.

Therefore, while lawmakers in Baton Rouge spent 19 consecutive weeks raising taxes on individuals and employers, D.C. bureaucrats were hard at work writing regulations. A particular law that will have an impact on small businesses’ operations is the “DOL federal overtime rule.” Under this new law, which goes into effect Dec. 1, 2016, the white-collar overtime exemption threshold under the Fair Labor Standards Act will change.

The revised overtime pay regulations, which are estimated to affect at least 4.2 million American employees, will increase the salary threshold for the overtime exemption from $455 a week, or $23,600 annually, to $913 a week, or $47,476 annually. As a result, businesses will need to start tracking hours for salaried exempt employees who are at or below the $47,476 threshold, or change their pay practices for these employees.

I spoke with a Baton Rouge business owner recently who shared his experience in adjusting his business practices to accommodate for the new salaries under the federal regulation. John Overton of TurnKey Solutions in Baton Rouge noted:

“Building a career progression plan for our staff is an important part of keeping them engaged with the growth of the company. Our business has an ebb and flow of large IT infrastructure or security projects.

Although our team members stay busy year round, some of our technicians put in a lot of overtime when there is a surge of projects in which they have a leadership role. So how do we reward and promote some lead technicians who occasionally get project manager responsibilities, but are not ready yet to be promoted to a manager role? One of the models we were leaning towards was to change them from hourly to salary with a raise to spread out these surges in overtime. Though they may end up making a similar amount with salary as they were hourly plus overtime, a higher base salary would have many benefits like planning their personal budget and improving their credit.

The federal overtime rule would affect these kinds of employees. They are not paid as much as managers, but they could still benefit greatly from a predictable salary. If I have to pay them overtime on top of wages, then this option for promotion and career progression is no longer viable, so back to the drawing board. Once again the government is interfering with my ability to take care of my team members the way I know best.”

So ultimately, this new federal overtime regulation was composed to help employees, but in the end, it only serves to hurt them. It is why the Louisiana Association of Business and Industry (LABI) consistently beats the drum that the government meddling in the private sector is unnecessary and detrimental to employers.

The fact that small firms continue to hire employees and grow their businesses in the midst of state lawmakers raising close to $2 billion of taxes on employers and the federal government continuing its quest to impose costly regulations speaks volumes to the zeal and commitment of small business owners to succeed, no matter the odds.

Renee Amar is Director of the Louisiana Association of Business and Industry’s Small Business Council and Health Care Council. Read more at www.labi.org

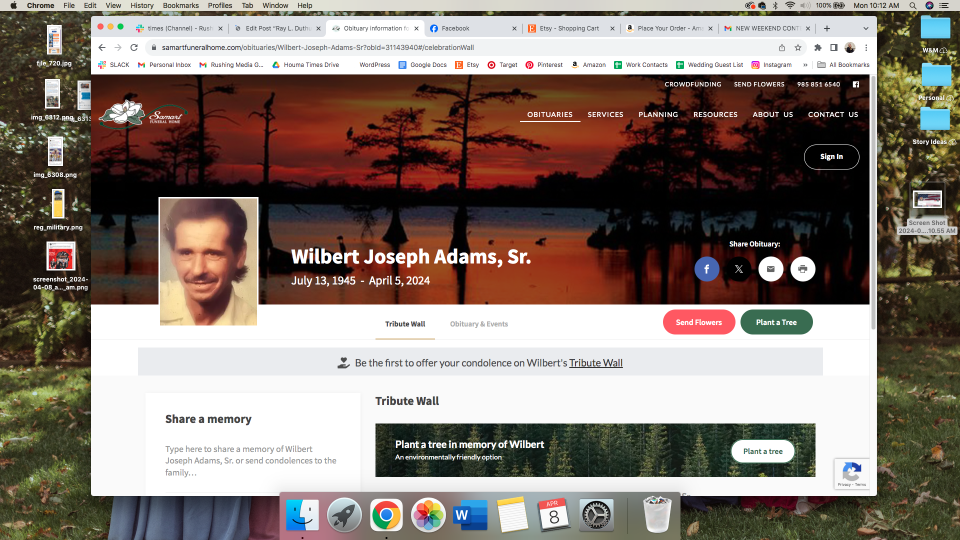

The Louisiana capital building on a clear, sunny day. Regulations set at the building are greatly impacting the state’s small businesses.